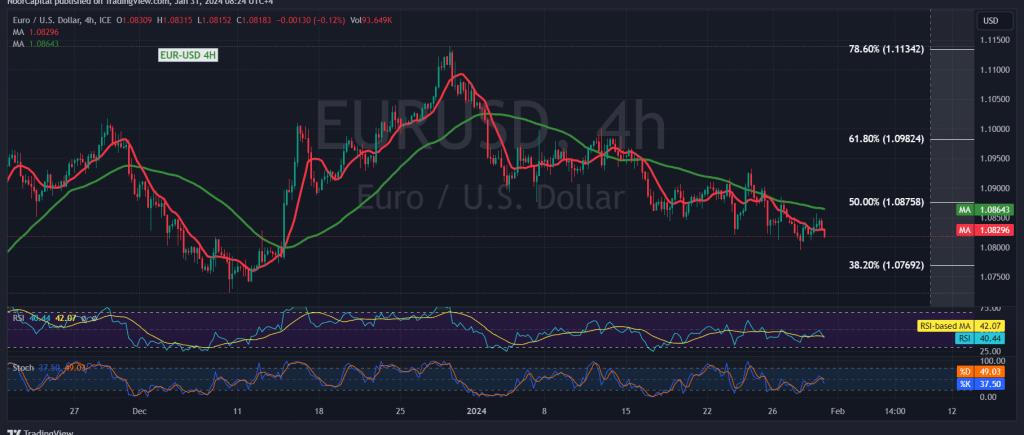

The Euro continues its downtrend against the US Dollar as anticipated in the previous technical report, reaching the initial target at 1.0810 and registering a low at 1.0812.

The technical outlook remains consistent. Examining the 4-hour time frame chart, the Euro is presently consolidating below the sub-resistance level of 1.0860, and more importantly, below the primary resistance at 1.0890. This is accompanied by sustained negative pressure from the simple moving averages.

As long as the Euro stays below 1.0860, and crucially beneath the primary resistance level of 1.0890, there’s potential for further decline. Initial downside targets include 1.0810, with the official target around 1.0870 (the 38.20% Fibonacci retracement). Extended losses may reach 1.0830.

A break above 1.0890, with the price consolidating beyond, would defer the likelihood of a decline. In such a scenario, we could see a retest of 1.0935 and 1.0970, corresponding to the 61.80% Fibonacci retracement.

Cautionary Note: Today, significant economic data is expected from the American economy, including changes in private non-agricultural sector jobs, the interest rate, the Federal Reserve Committee statement, and the press conference of the Federal Reserve Chairman. Sharp price fluctuations are anticipated during the release of this high-impact news.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations