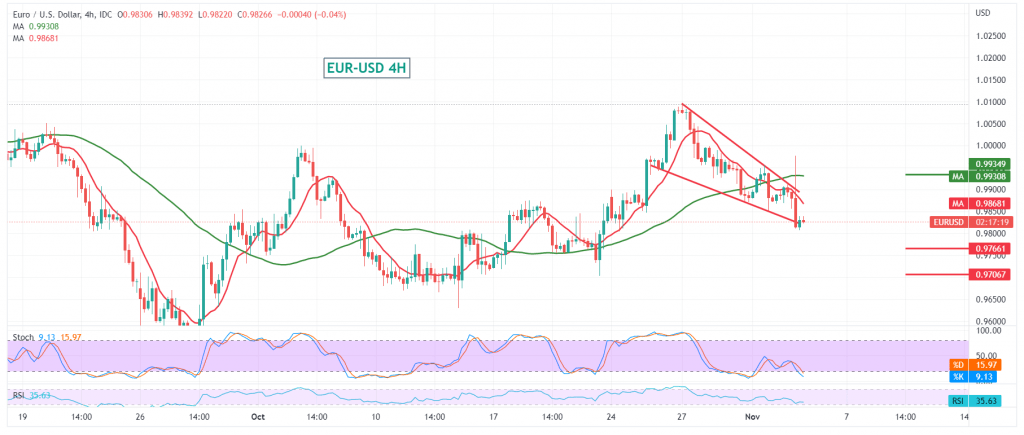

The movements of the euro against the dollar witnessed a clear fluctuation after the Federal Reserve decided to raise interest rates by 75 basis points to reach an interest rate of 4.0%. However, the movements remained negative within the bearish technical path as we expected, approaching the first target station yesterday at 0.9795, to be satisfied with recording its lowest level at 0.9812.

On the technical side, today, and carefully looking at the 240-minute chart, we notice the continuation of the price stability below the 50-day simple moving average, which continues to exert negative pressures on the price from above, and is motivated by the clear negative features on the stochastic indicator, which continues to lose bullish momentum.

Therefore, the bearish scenario may remain valid and effective, complementing the objectives of the previous analysis 0.9790/0.9770, initial targets, considering that the decline below 0.9770 extends the euro’s losses so that we will be waiting for the next 0.9710 official station.

In general, we continue to suggest the overall bearish trend as long as the pair’s trading is stable without the psychological resistance of 1.0000.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9770 | R1: 0.9940 |

| S2: 0.9710 | R2: 1.0035 |

| S3: 0.9610 | R3: 1.0095 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations