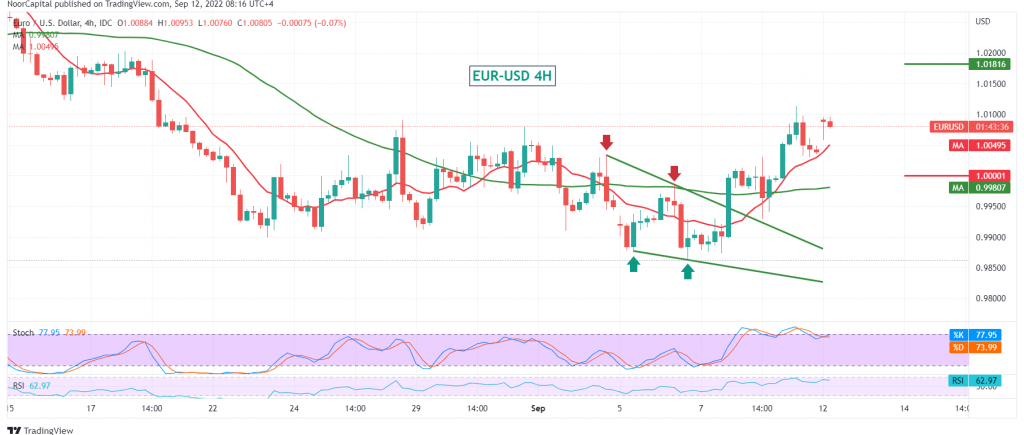

Positive movements dominated the Euro against the US dollar, beginning to form a corrective ascending wave, heading to touch the required target during the previous analysis at 1.0130, recording its highest level at 1.0124 during the early trading of the current session.

On the technical side, the simple moving averages continue to support the bullish curve for prices, accompanied by the pair getting positive momentum signals from the 14-day momentum indicator on the short time frames.

Therefore, the chances of continuing the rise are still valid and effective, provided that we witness a breach of the 1.0140 resistance level, extending the Euro’s gains, paving the way towards 1.0195/1.0180, an initial profit-taking area. The corrective ascent may extend later towards 1.0240.

From below, the decline below the parity point 1.0000, the previously breached resistance, which is now turned into a support level, invalidates the activation of the suggested scenario and leads the pair to the official descending path to retest 0.9920/0.9940 before attempts to rise again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0000 | R1: 1.0140 |

| S2: 0.9940 | R2: 1.0195 |

| S3: 0.9880 | R3: 1.0265 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations