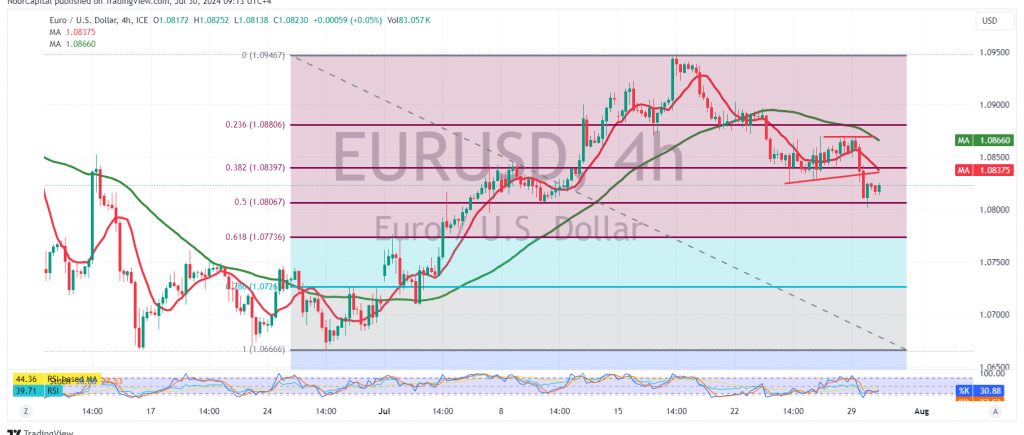

The Euro continued its decline against the US Dollar, following the anticipated downward trajectory outlined in the previous technical report. The pair reached the first official target at 1.0810, hitting a low of 1.0802.

On the technical front today, a closer examination of the 240-minute chart reveals that the simple moving averages are exerting downward pressure on the price. Additionally, daily trading remains below the pivotal resistance level of 1.0880.

Given these factors, there is potential for the pair to resume its downward correction, possibly reaching the next target of 1.0775, which aligns with the 61.80% Fibonacci retracement level. Should the price dip below this level, further downward movement could extend to 1.0730.

Conversely, if the pair manages to stabilize above the 1.0880 resistance level, which corresponds to the 23.60% Fibonacci retracement, we could see a bullish reversal. In this scenario, the pair may aim for an initial target of 1.0950.

Caution: Today, we anticipate the release of high-impact economic data from the US, specifically the “Consumer Confidence” report. This data may trigger significant price volatility around the time of its release.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations