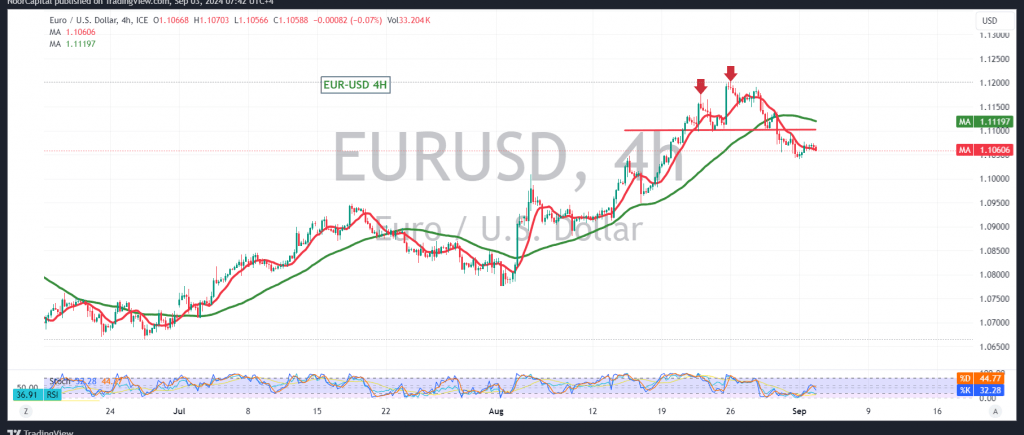

The EUR/USD pair experienced a gradual decline in the early trading sessions this month, driven by the U.S. dollar’s attempts to stage a rebound. As a result, the pair has remained generally stable below the psychological resistance level of 1.1100.

From a technical perspective, a closer look at the 4-hour chart reveals that the simple moving averages continue to exert downward pressure on the price, supporting the ongoing bearish trend.

Given this setup, there is potential for a continuation of the downward correction if the pair decisively breaks the support level at 1.1040. Such a move could pave the way for a decline towards 1.0990, with a possible extension to 1.0950.

On the upside, if the pair manages to regain stability above 1.1100, we could see a positive shift in momentum, with initial targets at 1.1140.

Warning: Trading CFDs involves significant risks. The scenarios outlined above are illustrative and should not be construed as recommendations to buy or sell. They represent an analytical view of potential price movements on the chart.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations