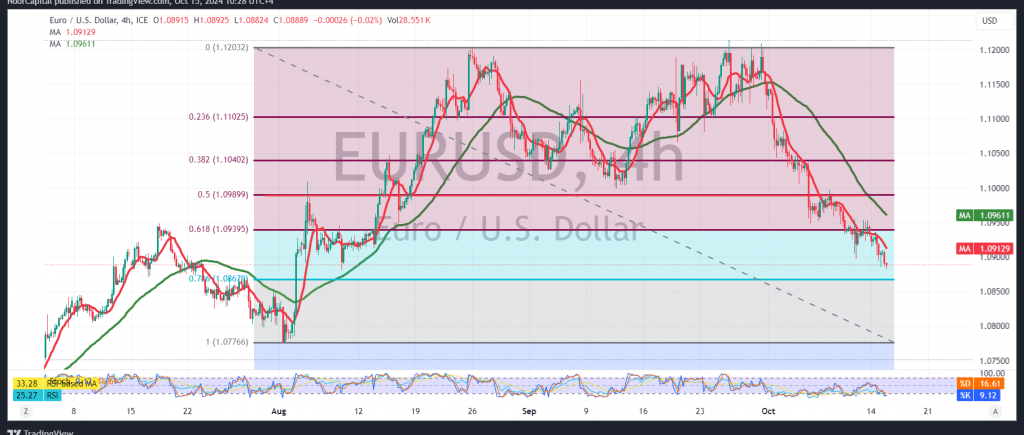

The EUR/USD pair began the week with a notable decline, aligning with the anticipated downward trajectory from the previous technical report. The pair hit the target of 1.0880, with its lowest level recorded at 1.0882 during morning trading.

From a technical standpoint, on the 4-hour chart, the simple moving averages continue to exert negative pressure on the price from above. Additionally, the pair’s break below the 1.0940 support level, now acting as a resistance at the 61.80% Fibonacci correction, confirms the bearish outlook.

Thus, the downward trend remains the most probable scenario, with targets at 1.0830 initially and 1.0780 as the next significant support level.

However, should the pair successfully close an hourly candle above the 1.0940 resistance level, it could regain strength in the short term, aiming for 1.0970 and 1.1020, respectively.

Warning: The risk level is high due to ongoing geopolitical tensions, and all scenarios are possible.

Risk Warning: The risk level remains high amid ongoing geopolitical tensions, and all scenarios are possible.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations