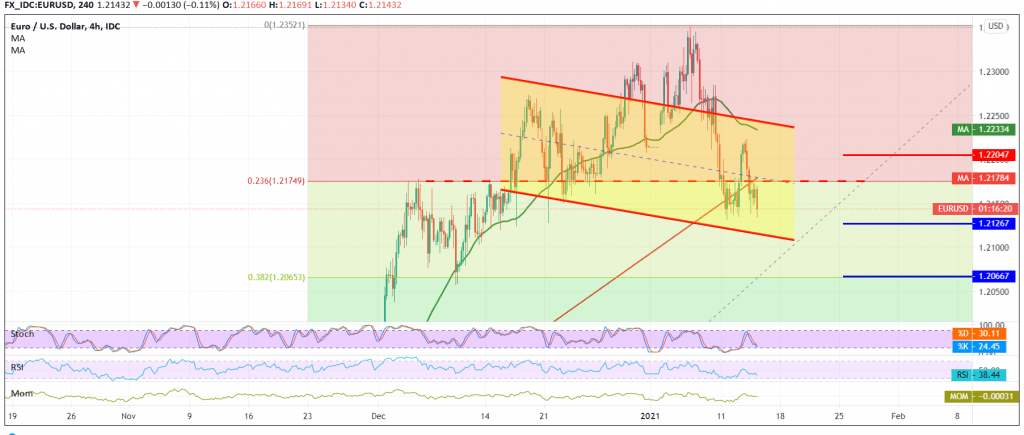

We stayed on the fence during the previous analysis due to the conflict of technical signals, explaining that the activation of short positions needs to witness a clear break and stability again below 1.2170, which puts the price under negative pressure with the first target of 1.2130 so that the pair recorded its lowest level during early trading for the current session 1.2133.

Technically speaking, and with a closer look at the 240-minute chart, we find that the trades returned to settle below 1.2170 located at the 23.60% Fibonacci, and we find that the RSI indicator began to gain bearish momentum on short time frames.

Therefore, the bearish bias is likely today, targeting 1.2110, bearing in mind that confirming the breach of the aforementioned level extends the pair’s losses, so that the way is open directly towards 1.2065 Fibonacci retracement of 38.20%, a next official station.

From the top, to move upwards and rise again above 1.2170, and the most importantly, 1.2200 is able to negate the bearish scenario, and the pair will recover again, with the target of 1.2255.

| S1: 1.2110 | R1: 1.2200 |

| S2: 1.2065 | R2: 1.2255 |

| S3: 1.2025 | R3: 1.2285 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations