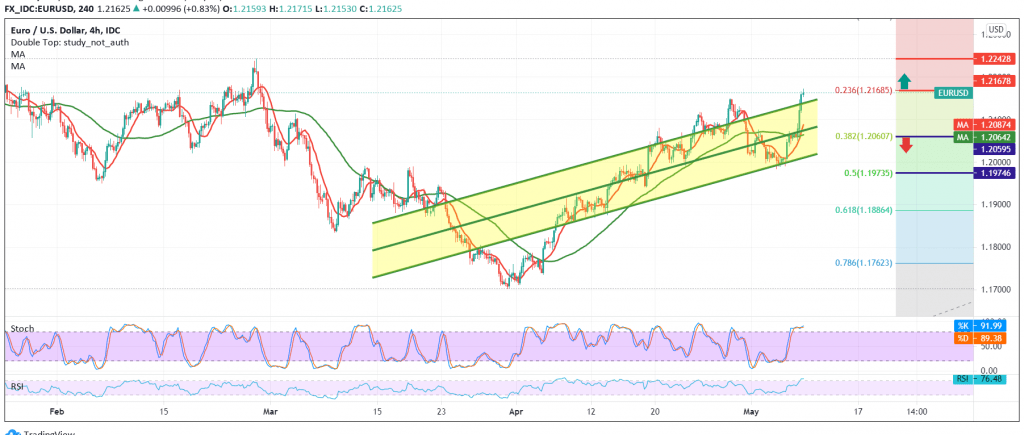

Positive trading dominated the euro’s movements against the US dollar at the end of last week’s trading, after it succeeded in surpassing the upside and breaching the pivotal resistance at 1.2065, explaining that confirming the breach of the aforementioned level paves the way for the euro to visit 1.2170, recording a high of 1.2170.

Technically, and with a closer look at the 4-hour chart, we find the simple moving averages continue to provide a positive incentive that hold the price from below, and we find the RSI indicator continues to provide positive signals on short intervals.

From here, and with the pair’s success in breaching the resistance level of 1.2065, which is now converted to the support level of 38.20% Fibonacci correction, it encourages us to maintain our positive expectations, provided that the breach of 1.2170 is confirmed, the 23.60% retracement, which extends the pair’s gains to visit 1.2205, a first target, and then 1.2260 an official next stop.

Only from below is the return of trading stability again below 1.2065 will immediately stop the aforementioned bullish bias and put the price under negative pressure targeting a retest of 1.2010, and then 1.2175, a 50.0% retracement.

Note: Stochastic is around overbought areas.

Note: we may witness a bearish tendency before attempting to rise again.

| S1: 1.2085 | R1: 1.2205 |

| S2: 1.2010 | R2: 1.2250 |

| S3: 1.1975 | R3: 1.2325 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations