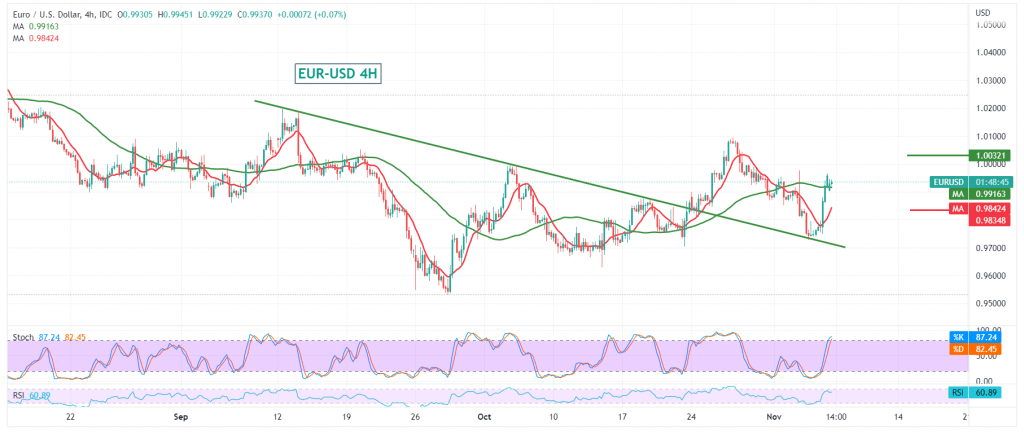

The single European currency reversed the expected bearish trend during the previous analysis, supported by the decline of the US dollar after the US jobs data, to end the trading sessions last week on a high, recording the highest 0.9966.

The technical aspect today indicates the possibility of resuming the rise, based on the return of the price stability above the simple moving average, which returned to carry the price from below, in addition to the positive momentum signals on the short time frames.

From here, trading steadily above the previously breached resistance and turned into a support level at 0.9880, and in general, above 0.9830, the bullish bias is most likely during the day, targeting the extended resistance 1.0030/1.0000, a first target, knowing that the confirmation of the breach of 1.0030 extends the pair’s gains, to be waiting for 1.0110.

The stability of trading below 0.9830 postpones the chances of rising and leads the pair to retest 0.9790 and 0.9750 before attempting to rise again.

Note: Stochastic is about overbought areas in an intraday basis.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 0.9795 | R1: 1.0025 |

| S2: 0.9660 | R2: 1.0110 |

| S3: 0.9575 | R3: 1.0240 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations