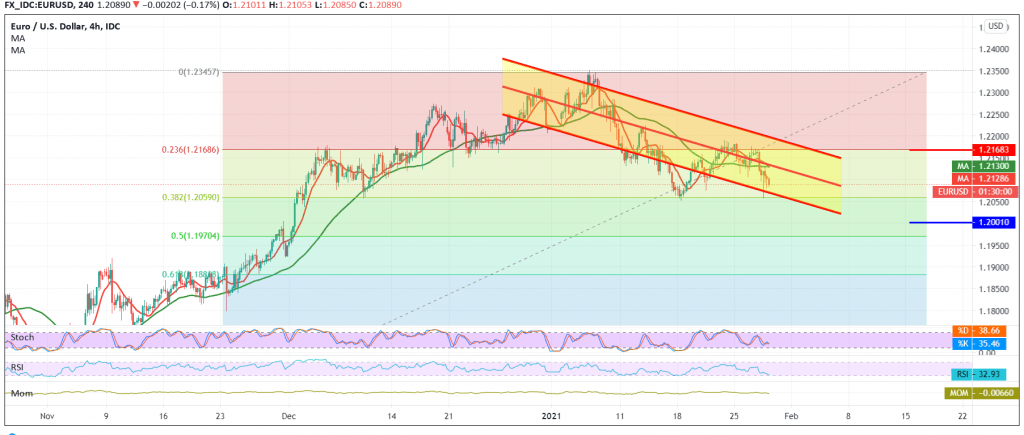

Negative trading dominated the moves of the euro against the US dollar within the expected bearish path, in which we relied on confirming a break of 1.2120 in his way to touch the first official leg of the break 1.2065, recording its lowest price at 1.2058.

Technically, and with a closer look at the 4-hour chart, we find the 50-day moving average continues to pressure the price from the top. This comes in conjunction with the negative signs coming from the stochastic indicator.

From here and steadily trading below the broken support level 1.2010 and in general below 1.2175 Fibonacci correction 23.60%, the bearish bias will remain valid and effective targeting 1.2045, and then 1.2000 next official stations and may extend later towards 1.1970, a 50.0% correction before rising again.

To remind you that trading remaining below 1.2175 is an important and essential condition to activate the suggested scenario.

| S1: 1.2045 | R1: 1.2155 |

| S2: 1.1995 | R2: 1.2220 |

| S3: 1.1930 | R3: 1.2265 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations