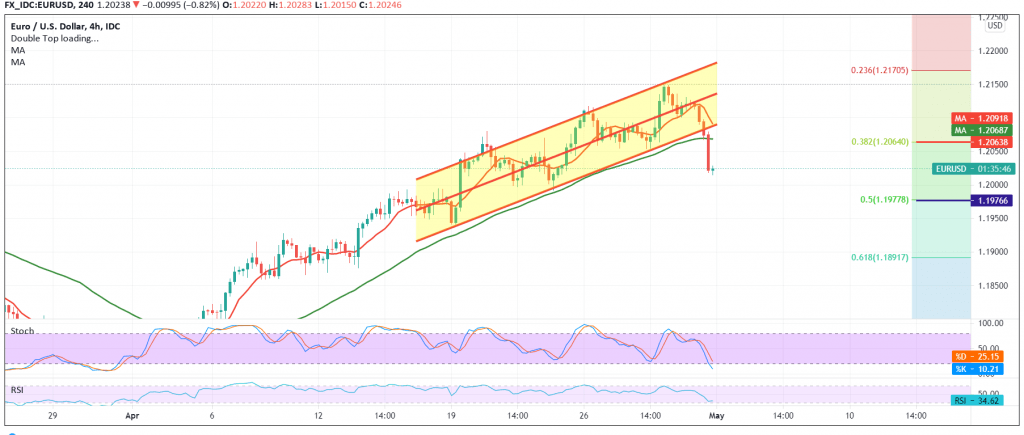

The single European currency fell significantly at the end of last week’s trading touching support mentioned in the previous analysis in which we aimed to re-test 1.2060, indicating that breaking the aforementioned level leads the euro to extend its losses towards 1.2030, to record its lowest level at 1.2015.

Technically speaking, and with a closer look at the 240-minute chart, we find that the simple moving averages returned to pressure the price from the top, coinciding with the stochastic gradually losing the bullish momentum.

From here, with the failure of the pair to stabilize above 1.2060/1.2070 Fibonacci retracement of 38.20%, therefore, the bearish bias is likely today, targeting 1.1975 a 50.0% correction as a first target, bearing in mind that trading below 1.1975 increases and accelerates the strength of the bearish corrective tendency, opening the way towards 1.1940 initially.

Only from the top to move upwards and rise again above 1.2070 and the most importantly 1.2070 negates the bearish scenario, and the euro regains its recovery against the dollar, targeting 1.2170, a 23.60% correction.

| S1: 1.1975 | R1: 1.2090 |

| S2: 1.1940 | R2: 1.2170 |

| S3: 1.1900 | R3: 1.2210 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations