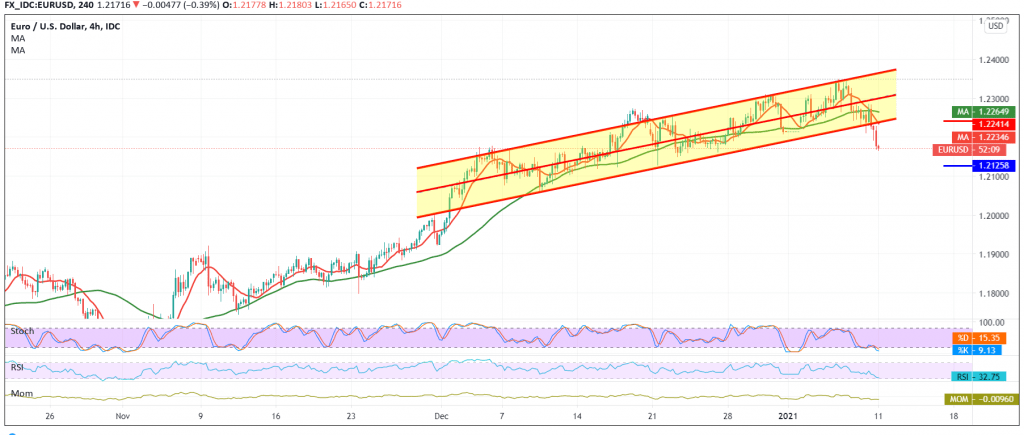

Negative trading dominated the euro’s movements against the US dollar, as we expected touching the official station mentioned in the previous report on Friday at 1.2170, recording its lowest trading during the Asian session at 1.2166.

Technically, looking at the 240-minute chart, we find the simple moving averages continue their negative pressure on prices, and the 50-day moving average meets around 1.2245 and adds more strength to it, this comes in conjunction with the continued obtaining of negative signals for the pair, which is clear on the RSI On short timeframes.

Consequently, the bearish scenario will remain valid targeting 1.2130 then 1.2085. It should also be noted that confirming the last break extends the pair’s losses so that the way is directly open towards 1.2020.

A reminder that surpassing the upside and rising again above 1.2245 will stop the daily bearish trend, and the pair will recover again with the initial target of 1.2330.

| S1: 1.2130 | R1: 1.2245 |

| S2: 1.2085 | R2: 1.2325 |

| S3: 1.2010 | R3: 1.2365 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations