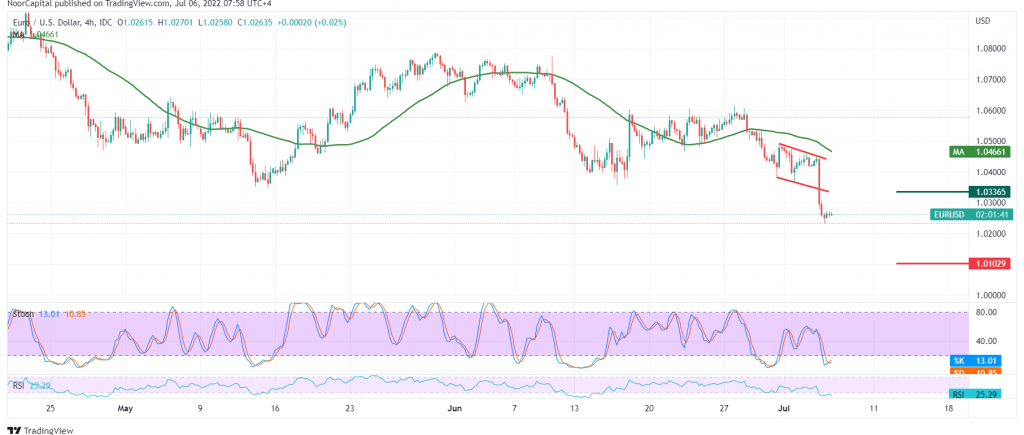

EURUSD incurred noticeable losses during the last trading session, within the expected bearish technical outlook in the previous analysis, explaining that the official target of the current downside wave is its target at 1.0285, recording its lowest level at 1.0235.

Technically and carefully considering the 4-hour chart, we notice the continuation of negative pressure from the simple moving averages that support the bearish price curve, accompanied by the 14-day momentum indicator gaining bearish momentum.

Therefore, the resumption of the decline is most likely today, knowing that trading below 1.0200 and most importantly 1.0185 can extend the current descending wave to be waiting for the next 1.0100 price station.

Trading stability below 1.0300, and most importantly 1.0340, are basic conditions to maintain the suggested scenario, and to cross upwards to the previously broken support-into-resistance at 1.0335, postpones the downside opportunities and supports the idea of retesting 1.0400 before determining the next price movement.

Note: The Fed’s statement is due today and could lead to some volatility

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0185 | R1: 1.0400 |

| S2: 1.0100 | R2: 1.0530 |

| S3: 0.9975 | R3: 1.0610 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations