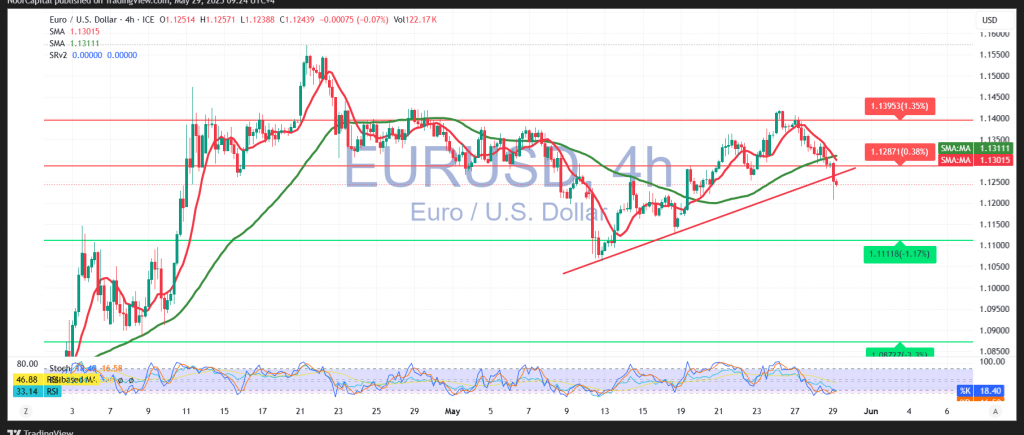

The euro weakened against the U.S. dollar in the previous session after encountering strong resistance at 1.1350, aligning with the target highlighted in the previous report. The pair recorded a session high of 1.1345 before retreating sharply. As expected, an hourly candle close below 1.1270 has postponed the upside potential, and the pair has since retested 1.1230, extending the decline toward 1.1210.

The 4-hour chart reveals a decisive break below the minor uptrend support line, accompanied by continued negative pressure from the simple moving averages, which act as dynamic resistance around 1.1290. Given these technical factors, the bias favors further downside potential, with the next targets at 1.1190 and 1.1140. However, this bearish outlook remains contingent on daily trading stability below 1.1290. A sustained move above this level could challenge the bearish case and signal the possibility of a recovery.

Traders should exercise caution ahead of the release of key U.S. economic data, including Preliminary GDP (Quarterly) and Weekly Unemployment Claims. These reports are likely to generate heightened market volatility, particularly in the EUR/USD pair. Given ongoing global trade tensions and macroeconomic uncertainty, risk levels remain elevated. Traders should be prepared for multiple scenarios and potential sharp price swings.

Risk Disclaimer:

With ongoing global trade tensions and key economic data in focus, risk levels remain elevated. Traders should remain vigilant and prepare for potential sharp price swings in either direction.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations