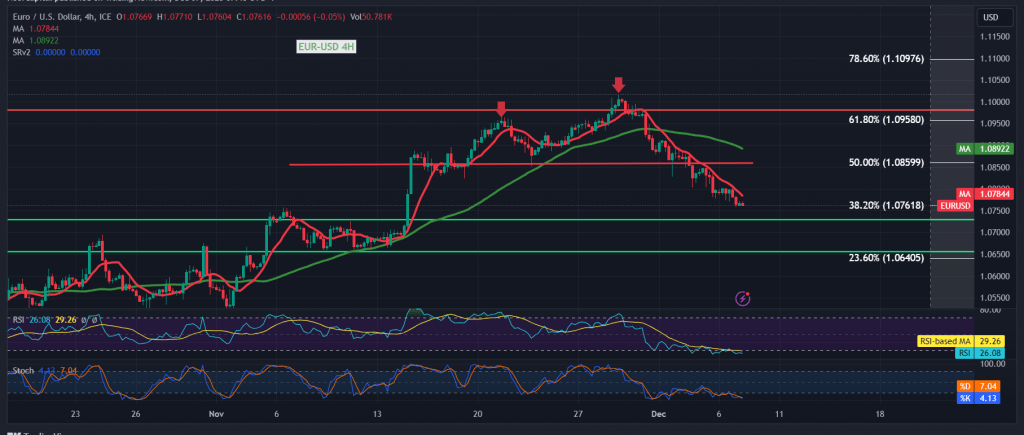

The EUR/USD pair is currently exerting downward pressure on a robust support level, as highlighted in the previous technical report, positioned at 1.0760 and characterized by a descending trend.

From a technical standpoint, intraday movements today demonstrate a sustained position below the pivotal resistance of the psychological threshold at 1.0800. More significantly, this occurs beneath the previously breached support, now transformed into a resistance level at 1.0860, aligning with the 50.0% Fibonacci retracement and the 50-day simple moving average. The convergence of these factors fortifies the resistance, reinforcing its significance.

In light of this, the bearish scenario maintains its validity, with an initial target set at 1.0740. A breach of this level would compel the pair to persist in its gradual descent, setting the stage for the subsequent target at 1.0700. Further losses might extend towards 1.0670.

Only an upward breakthrough, coupled with a sustained position and closure above 1.0860 for at least an hour candle, would shift the market dynamics. This development would postpone the likelihood of a decline, ushering in a potentially positive trading session with the objective of retesting 1.0920 and 1.0960, representing the 61.80% Fibonacci retracement.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations