the EUR / USD pair approached the first target to be achieved at 1.1920, its highest level during the previous session’s trading at 1.1906 and traded on a positive note.

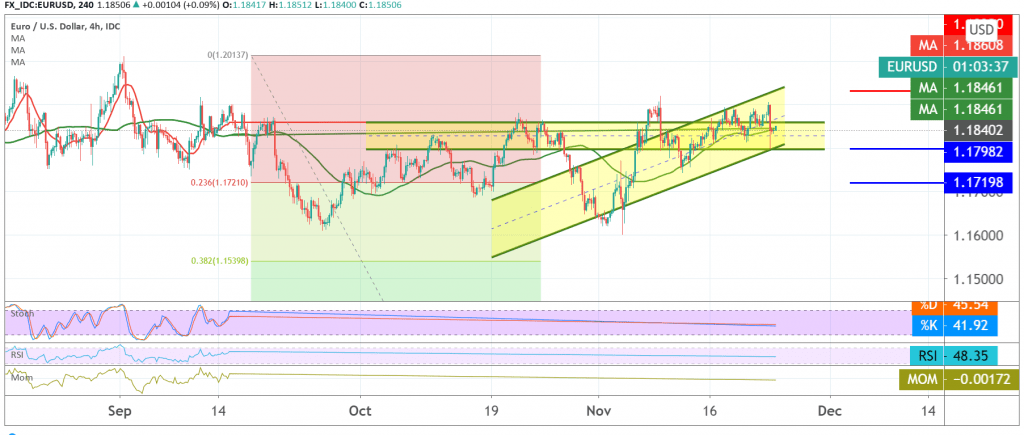

Technically, the pair found a solid support ground around the psychological barrier of 1.1800 and ended above the aforementioned level, and with a closer look at the 240-minute chart, we find that there is a conflict in the technical signals, and we notice the 50-day moving average that presses the price and meets around the minor resistance 1.1865. / 1.1880, in support of the bearish bias, and on the other hand, we find Stochastic trying to get rid of the current negativity, accompanied by stability above 1.1800.

From here, and with the conflict of technical signals, we will stand on the fence for a moment to obtain a high-quality deal, and we will be facing one of the following scenarios:

The stability of trading above 1.1800 and the surpassing the upside of 1.1880 resistance is a catalyst that enhances the chances of an upside move towards 1.1920 a first target, and 1.1970 a next stop after it.

Activation of short positions will confirm the breach of 1.1800, and from here we are witnessing a bearish trend with an official target of 1.1720 Fibonacci retracements of 23.60%. Daily directional keys from below 1.1800 and above 1.1880.

| S1: 1.1800 | R1: 1.1910 |

| S2: 1.1745 | R2: 1.1960 |

| S3: 1.1690 | R3: 1.2010 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations