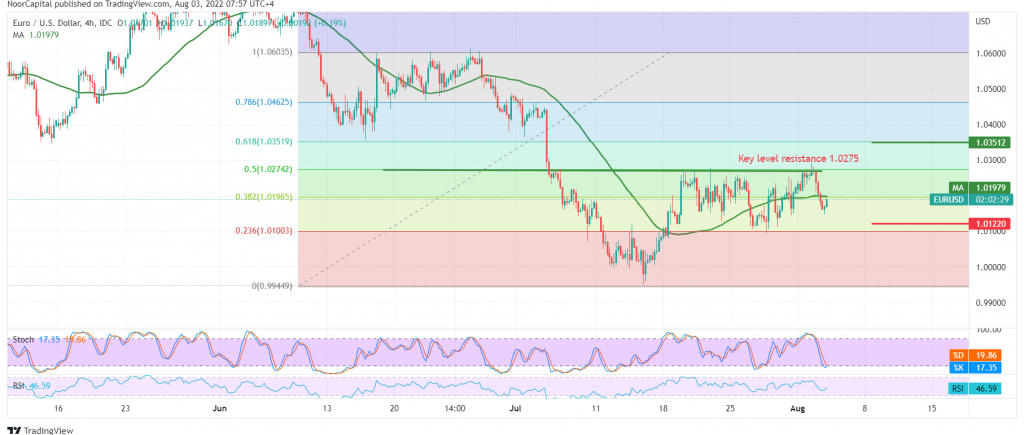

Mixed trading dominated the movements of the euro-dollar, heading to approach the first official station targeted during the previous report 1.0300, to settle for recording the highest level at 1.0293, which formed a strong resistance level around the psychological barrier that forced the pair to the downside to retest the 1.0160 support level during the morning session of the current session.

Technically and carefully considering the 4-hour chart, we find the euro returned to stability below the 1.0275 resistance level represented by the 50.0% Fibonacci correction. Furthermore, the pair returned to stability below the 50-day simple moving average, which supports the possibility of negativity; on the other hand, the pair successfully retested a support level 1.0160. The current intraday movements are witnessing stability above the mentioned level, supporting a bullish bias in the coming hours.

With conflicting technical signals and trading from below above 1.0160 and from above below 1.0275, we prefer to monitor the pair’s price behavior to be facing one of the following scenarios:

Confirmation of breaking 1.0150 puts the euro under strong negative pressure to target 1.0120 and 1.0065, awaited next stations, while trading stability returns again above the pivotal resistance level 1.0275, 50.0% correction. This is a catalyst that enhances the chances of the bullish bias returning with targets that start at 1.0350 and extend later to visit 1.0400.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 1.0120 | R1: 1.0265 |

| S2: 1.0065 | R2: 1.0350 |

| S3: 0.9980 | R3: 1.0410 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations