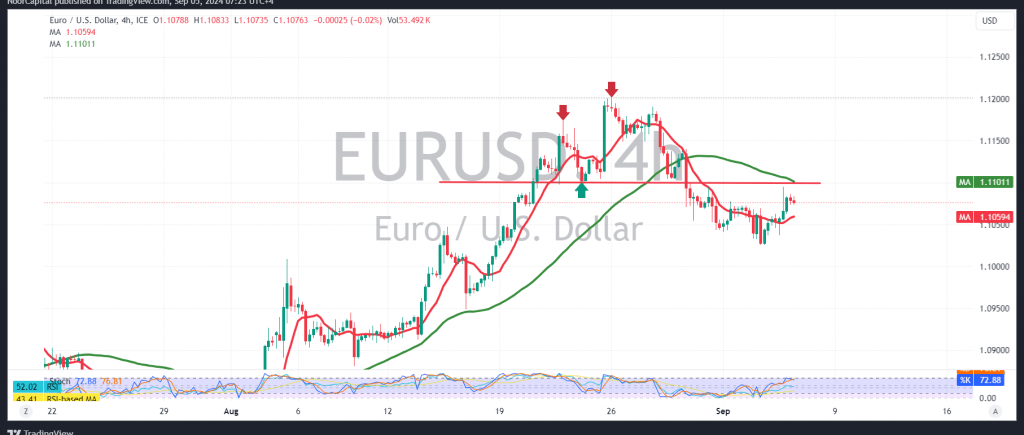

The EUR/USD pair found strong support near 1.1040, as previously noted, with the continuation of the bearish corrective trend hinging on a decisive break below this level. The pair managed to close above 1.1040, reaching a high of 1.1095.

From a technical perspective today, the 4-hour chart shows the pair stabilizing just below the psychological resistance at 1.1100, which coincides with the 50-day simple moving average, adding further strength to this barrier. Meanwhile, the 14-day momentum indicator continues to show positive signals, supporting a potential short-term upward trend.

Given these mixed technical signals, it’s advisable to monitor price behavior closely, as the pair could follow one of two scenarios:

- Upside scenario: If the price stabilizes above the psychological resistance at 1.1100, the pair may see short-term gains, with targets at 1.1130 and potentially extending to 1.1165.

- Downside scenario: If the pair slips below the 1.1040 support level, it could resume the corrective downward trend, with targets at 1.0990 and 1.0950.

Alert: High-impact U.S. economic data is expected today, including “Non-farm private sector jobs,” weekly unemployment claims, and the ISM Services Index. These releases may lead to increased price volatility.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations