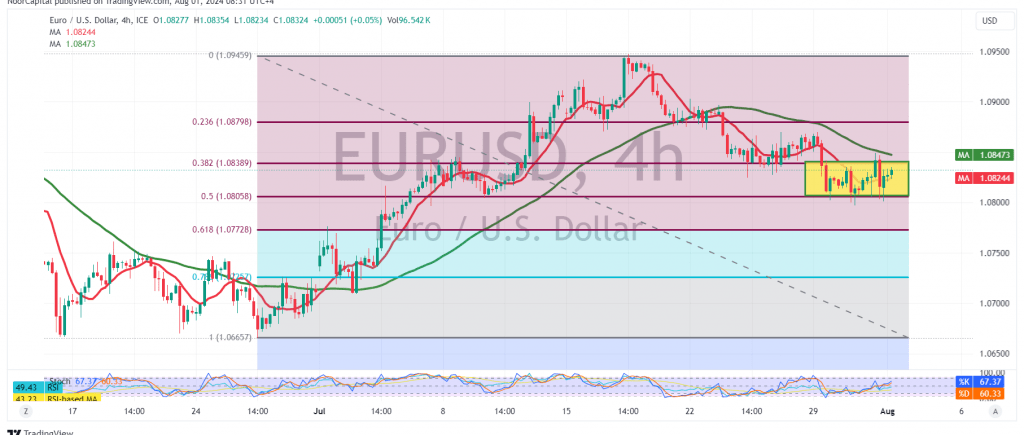

The EUR/USD pair experienced narrow sideways trading, confined between the support level at 1.0800 and the resistance level at 1.0850.

Technically, the 240-minute chart shows continued negative pressure from the simple moving averages, alongside the stability of daily trading below the pivotal resistance level of 1.0880.

Given these conditions, there is potential for a downward correction if the pair breaks clearly and strongly below the support level of 1.0805, which aligns with the 50.0% Fibonacci retracement level. This could lead to a move towards 1.0775, with further targets potentially extending to 1.0730.

On the upside, if the pair stabilizes above 1.0850, corresponding to the 38.20% Fibonacci retracement, we could see a recovery, targeting 1.0880 initially.

Caution: Today, significant economic data releases are expected, including the Bank of England’s interest rate decision, monetary policy summary, MPC vote on interest rates, and a speech by the Bank of England Governor, as well as US unemployment benefits and manufacturing PMI. These events could lead to high price volatility.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations