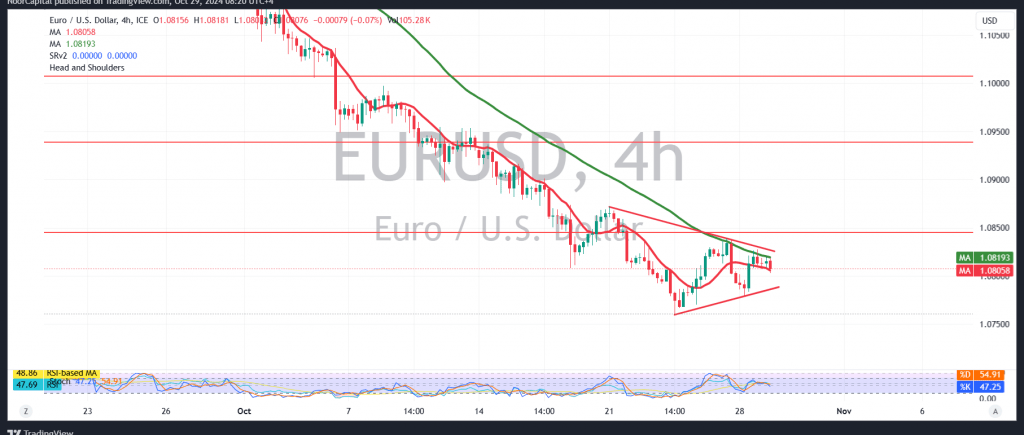

The EUR/USD pair has been trading sideways, attempting to hold above the support level of 1.0760. However, positive movement has been limited, with the pair struggling to rise above the main resistance at 1.0850.

Technical Analysis:

- On the 240-minute chart, the 50-day simple moving average indicates potential for further decline, coinciding with the Stochastic indicator showing a gradual loss of upward momentum.

- Although there are technical factors suggesting a possible decline, we advise waiting for a confirmed break below 1.0760. This could pave the way for a drop towards 1.0700 and then 1.0665.

- Conversely, if the pair closes above 1.0850 with at least one hourly candle, it could indicate a recovery, targeting a retest of 1.0880.

Warnings:

The risk level remains high amid ongoing geopolitical tensions, making all scenarios possible.

High-impact economic data is expected from the US economy, including Consumer Confidence and Job Openings and Labor Turnover, which may lead to increased price volatility during the news release.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations