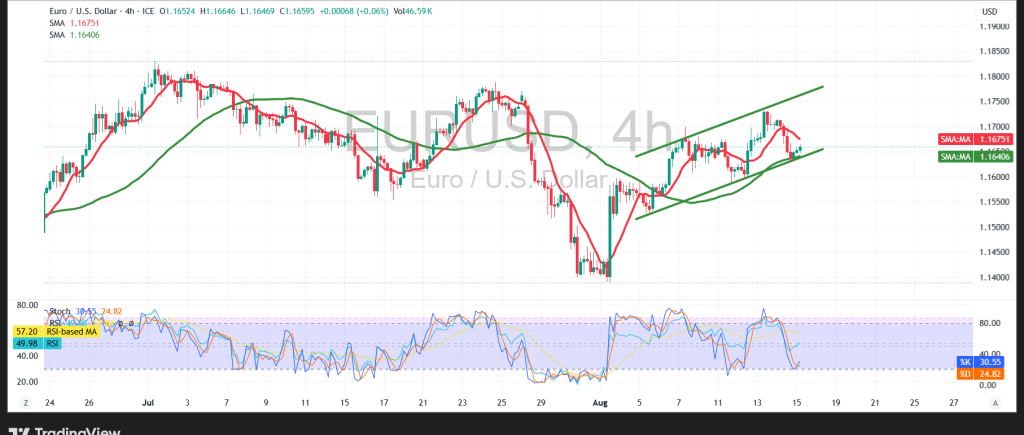

The EUR/USD pair retreated in the previous trading session after two unsuccessful attempts to close above the key psychological resistance at 1.1700.

Technical Outlook – 4-hour timeframe:

Despite the pullback, technical indicators remain supportive of a potential rebound, as the price continues to trade above the 50-period simple moving average. The Relative Strength Index (RSI) has also turned higher after reaching oversold territory, signaling the possibility of renewed bullish momentum. Furthermore, the pair remains within a minor ascending price channel, reinforcing the short-term upward bias.

Probable Technical Scenario:

As long as the pair holds above the 1.1620 support, the bullish outlook remains intact. A confirmed break above 1.1700 would act as a trigger for further gains toward 1.1740 as the first resistance, followed by 1.1770 as the next target.

Conversely:

A sustained move below 1.1620, confirmed by an hourly close, could revive selling pressure, paving the way for a decline toward 1.1585 as initial support, with 1.1530 as the next potential downside target.

Fundamental Note:

Today’s session features high-impact US economic releases, including retail sales, preliminary Michigan consumer confidence, and preliminary Michigan inflation expectations. These data points could generate substantial market volatility upon release.

Warning: Risks remain elevated amid ongoing trade tensions, and all scenarios should be considered.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations