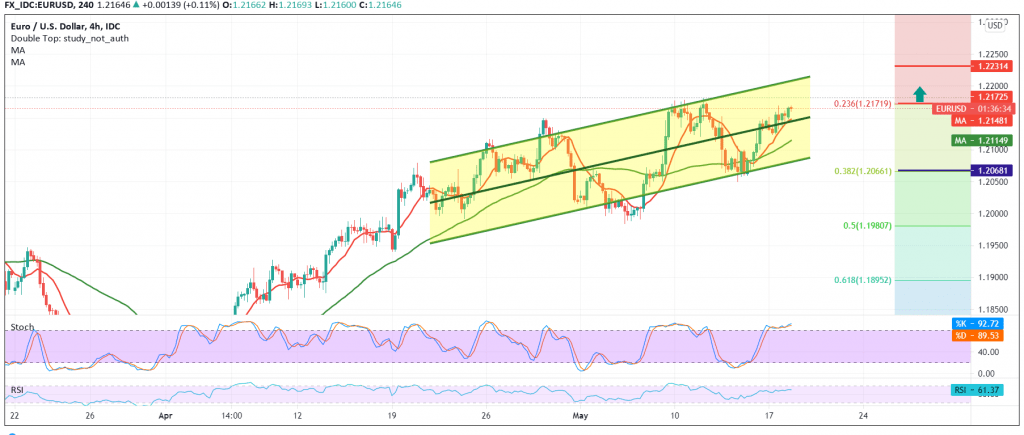

Quiet trading dominated the movements of the euro against the US dollar within a bullish path, heading to retest the official target published during the last analysis at the price of 1.2170.

Technically, and with a closer look at the 60-minute chart, we find the RSI stable above the 50 midline, accompanied by the positive stimulus coming from the 50-day moving average, which continues to hold the price from the bottom.

Despite the technical factors that support the bullish bias, we prefer confirming the pair’s breach of the pivotal resistance 1.2170 represented by the 23.60% Fibonacci correction, because this is a catalyst that enhances the chances of the upside to visit 1.2225 and then 1.2265, and the upside targets may extend later towards 1.2300.

In general, we are continuing to favor the upside in the short term, unless we witness any trading below the support level of 1.2070/1.2065, the 38.20% retracement.

Note: Stochastic is trading around overbought areas.

| S1: 1.2125 | R1: 1.2170 |

| S2: 1.2075 | R2: 1.2225 |

| S3: 1.2020 | R3: 1.2265 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations