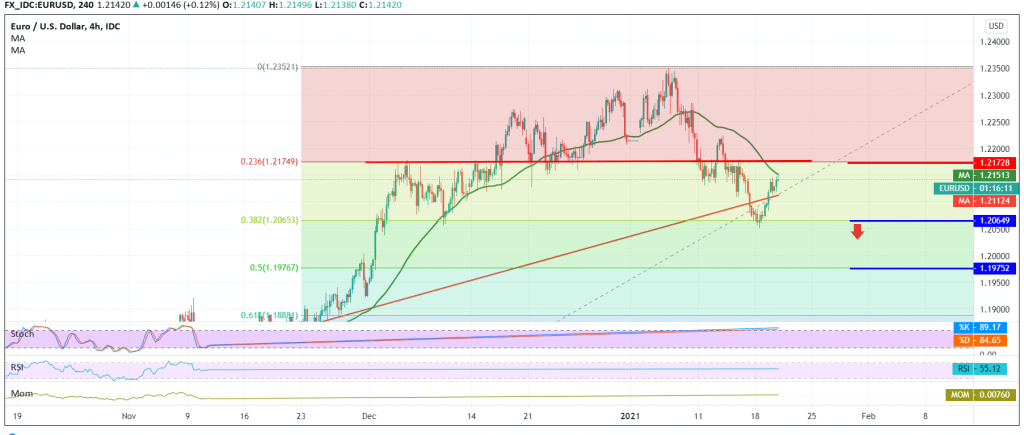

The movements of the euro against the US dollar witnessed a slight bullish tendency during the previous trading session within a rise to the upside, benefiting from building on the support level of 1.2065.

Technically, and with a closer look at the 60-minute chart, we find the 50-day moving average that returned to hold the price from below, and this comes in conjunction with the positive signs coming from the RSI and obtaining bullish momentum.

Despite the technical factors that support the possibility of continuing the bullish trend, we prefer to wait for the session for the second day in a row, until confirming the breach of the pivotal resistance 1.2170, Fibonacci retracement of 23.60%, which is a catalyst that enhances the bullish chances to visit 1.2200 and then 1.2245.

From below, if the pair fails to breach the aforementioned resistance to returning to trading and stabilizing below 1.2090, this may put the price under negative pressure targeting a re-test of 1.2065, a correction of 38.20%.

The break of 1.2065 is a signal to complete the bearish correction again with an initial target of 1.2000 and may extend later to 1.1975 50.0% retracement.

Note: The speech of US President-elect “Joe Biden” is due today and that may have a significant impact on the market movement.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations