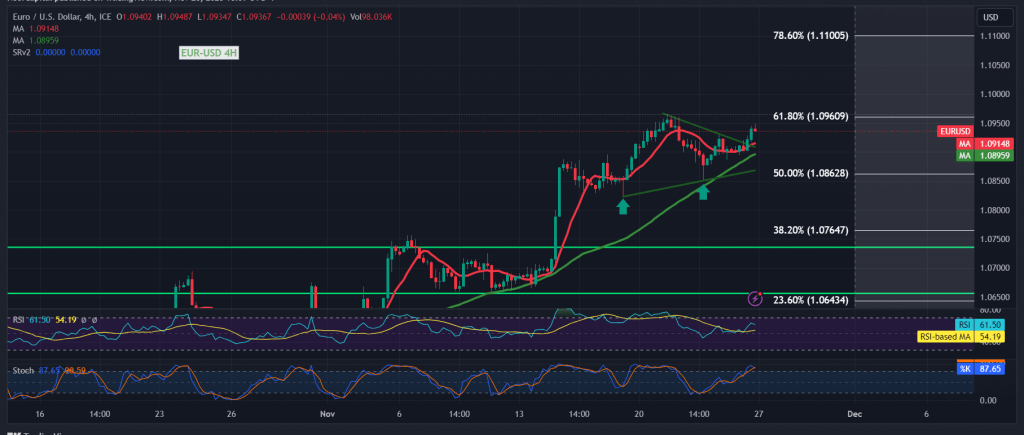

Positive trading prevailed in the Euro/Dollar pair at the close of last week’s trading, aligning with the anticipated upward trajectory outlined in the previous technical report. The pair approached the initial official target of 1.0960, reaching a peak of 1.0950.

From a technical perspective today, a positive inclination is observed, contingent on intraday trading stability above the resistance level of the psychological barrier at 1.0900. The pair is holding itself above the previously breached resistance, now converted into a support level at 1.0860 (50.0% Fibonacci retracement). Additionally, there’s positive support from the simple moving average.

Hence, the potential for an effective upward trend is present during today’s session. Confirmation of breaching 1.0960, the 61.80% Fibonacci retracement, serves as motivation for further ascent towards 1.0980 and 1.1030, acting as an official station. It’s crucial to monitor whether consolidation above 1.1030 will pave the way for additional gains towards 1.1100.

However, a return to stability below 1.0860, confirmed by the closing of at least an hourly candle, could entirely disrupt the suggested bullish scenario, leading the pair to retest 1.0800 and 1.0785.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations