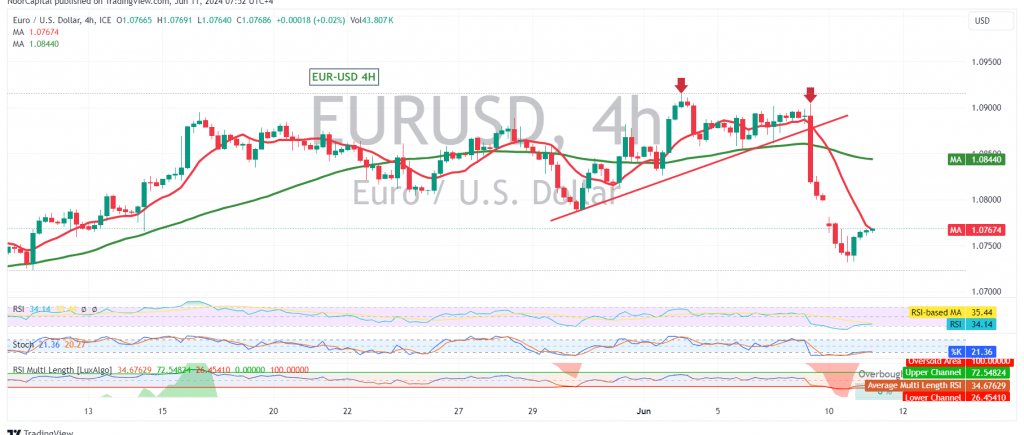

The EUR/USD pair continues its descent, aligning with our previous bearish forecast. After briefly testing the 1.0730 level, the pair is approaching our initial downside target of 1.0710.

On the 4-hour chart, we observe a potential retest of the recently breached 1.0760 support level. Simple moving averages maintain their downward pressure on the price, while the Stochastic oscillator’s loss of bullish momentum reinforces the bearish bias.

We maintain a bearish outlook and anticipate further downside movement. A confirmed break below the critical 1.0750 support level (50.0% Fibonacci retracement) would trigger our entry into short positions, targeting 1.0710 initially, followed by 1.0660.

However, a decisive move above 1.0800, and more importantly, a sustained break above 1.0840, would invalidate the bearish scenario. In this case, a temporary recovery towards 1.0875 and 1.0900 could be expected.

Traders are advised to exercise caution and wait for confirmation before entering short positions. This analysis is for informational purposes only and should not be considered financial advice.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations