The EUR/USD pair has experienced a notable surge in the early trading sessions this week, breaching the key psychological resistance level of 1.0900 and reaching a high of 1.0915.

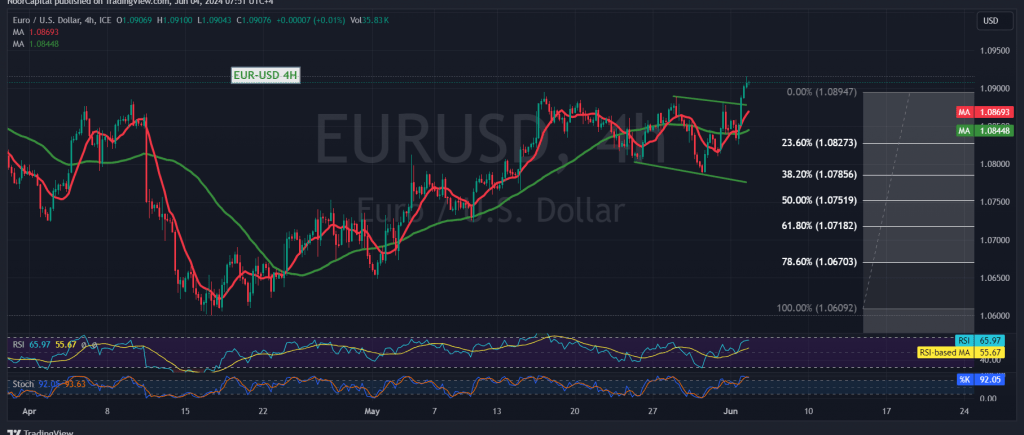

Technical analysis indicates a potential shift in momentum towards the upside. On the 4-hour chart, the simple moving averages have crossed above the price, signaling a possible continuation of the upward trend. Moreover, the pair has maintained its position above the 1.0895 resistance level and the previously broken resistance of 1.0850.

These factors suggest that the recent downward correction may have concluded, paving the way for further gains. The initial target for this bullish move is 1.0940, followed by the next significant level at 1.0975. If this momentum persists, the pair could even extend its gains towards 1.1010.

However, traders should remain vigilant as a return of trading stability below 1.0850 could negate the bullish outlook and trigger a resumption of the bearish trend. In this scenario, the pair could target 1.0785 and 1.0760 as initial downside objectives.

Caution is advised today as the U.S. economy is set to release high-impact economic data, including job vacancies and labor turnover rate figures. These announcements could introduce significant volatility into the market.

In conclusion, the EUR/USD pair is exhibiting a strong bullish bias, with the potential for further gains in the near term. However, traders should closely monitor the price action around key levels and be prepared for potential volatility due to the upcoming economic data release.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations