The EUR/USD pair kicked off the week with a notable surge, reaching a high of 1.0880 during today’s morning trading session.

Technical Analysis Supports Upward Momentum

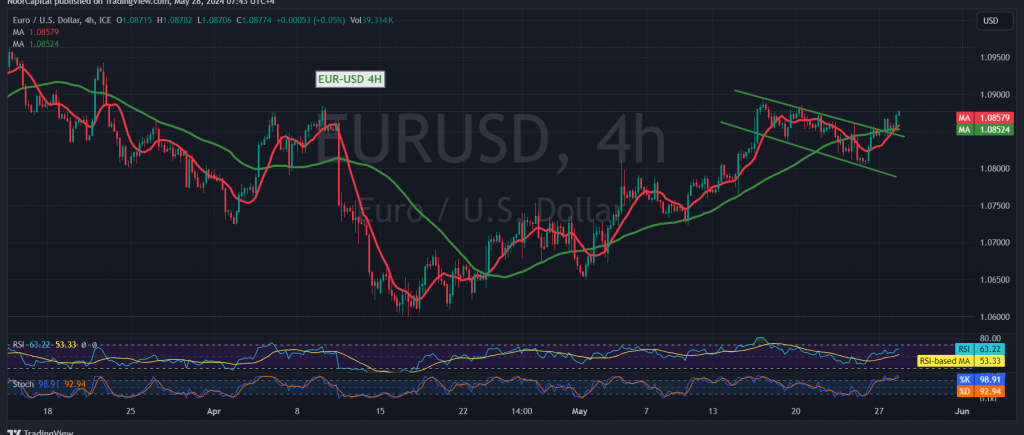

A close examination of the 4-hour chart reveals a bullish scenario. The simple moving averages have aligned to support the prevailing daily upward trend. Additionally, the 14-day momentum indicator shows clear positive signals, further bolstering the potential for continued gains.

Key Resistance Levels to Watch

As long as daily trading holds above the crucial 1.0800 level – which has transitioned from resistance to support – the upward trend remains the most likely path. The initial target is the 1.0900/1.0910 range. A decisive break above this range could pave the way for further gains, with 1.0950 and 1.0970 emerging as potential targets.

Downside Risks and Support Levels

Traders should remain vigilant, as a decline below 1.0810, and more significantly 1.0800, could quickly stall the upward momentum and trigger a bearish reversal. In such a scenario, an initial downside target near 1.0730 would come into play.

Important Note: Today’s release of the US Consumer Confidence Index could introduce significant volatility into the market. Traders should exercise caution and be prepared for potential price fluctuations around the news release.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations