The EUR/USD pair continued its upward trajectory, reaching our previously identified target of 1.0915 and peaking at 1.0922 during the first trading sessions of this week.

Technical Outlook:

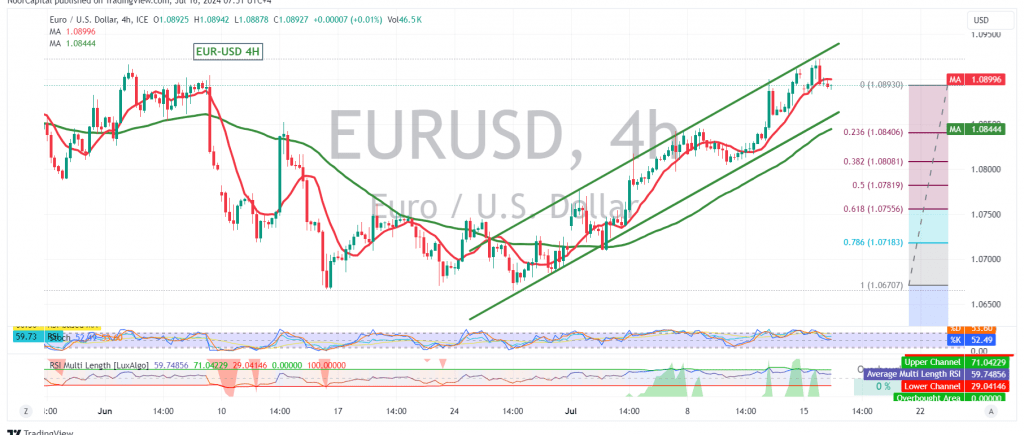

The technical outlook remains strongly bullish. On the 4-hour chart, the pair is receiving sustained positive momentum from the simple moving averages (SMAs) and is trading within an ascending price channel, both confirming the ongoing bullish trend.

Upward Potential:

With the current bullish momentum and the price holding above the 1.0840 support level, we anticipate further upward movement. The initial target is 1.0950, and a break and consolidation above this level could accelerate the rally towards 1.1000.

Downside Risks:

However, traders should remain cautious as a return of trading stability below the 1.0840 support level could trigger a bearish correction, targeting 1.0790 and 1.0760.

Key Levels:

- Support: 1.0840, 1.0790, 1.0760

- Resistance: 1.0950, 1.1000

Important Note:

The release of high-impact U.S. economic data today, including monthly retail sales and core retail sales excluding cars, could induce significant price volatility. Traders should closely monitor the market’s reaction to these data releases.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations