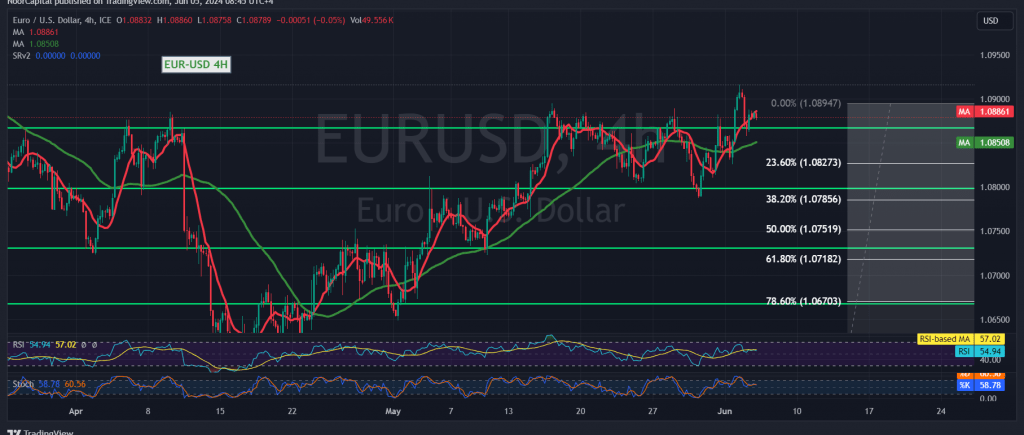

The EUR/USD pair experienced a downturn in the previous trading session, failing to maintain its position above the key psychological resistance level of 1.0900. However, technical indicators suggest a potential rebound in the upcoming sessions.

On the 4-hour chart, the simple moving averages are still providing support for the upward price movement, and the Stochastic oscillator is showing positive crossover signals, indicating a potential shift in momentum.

Given these factors, the upward bias is likely to dominate during the day. The initial target for this bullish move is 1.0940, followed by the next significant resistance level at 1.0975. If this momentum continues, the pair could even extend its gains towards 1.1010.

However, traders should exercise caution as a decisive break below the 1.0850 support level could invalidate the bullish outlook and trigger a resumption of the bearish trend. In this scenario, the pair could target 1.0785 and 1.0760 as initial downside objectives.

It’s important to note that today’s high-impact economic data release from the U.S. economy, specifically the “Change in Non-Agricultural Private Sector Jobs,” could introduce significant volatility into the market. Traders should be prepared for potential price fluctuations in response to this news.

In conclusion, while the EUR/USD pair has recently faced some downward pressure, the current technical indicators suggest a potential rebound. Traders should closely monitor the key support and resistance levels mentioned above and be prepared for potential volatility due to the upcoming economic data release.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations