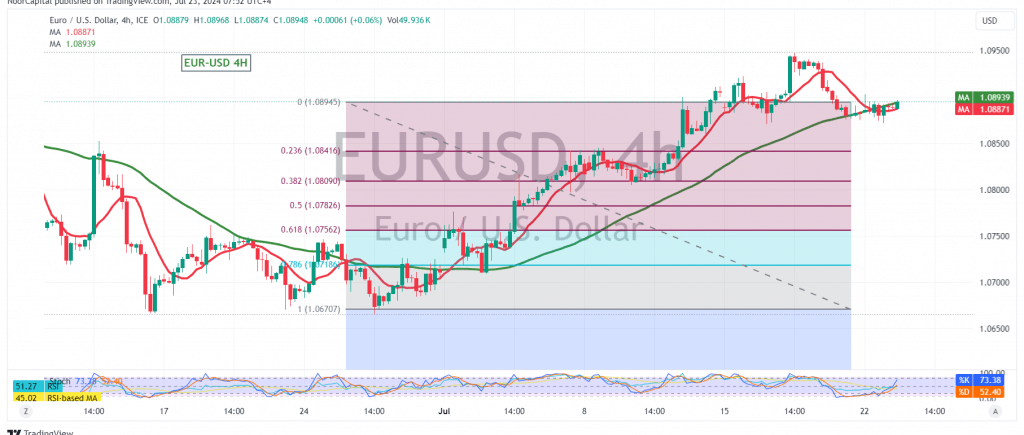

The EUR/USD pair is experiencing subdued trading at the start of this week, remaining below the key psychological resistance level of 1.0900.

Technical Outlook:

On the 240-minute chart, the Stochastic oscillator is gradually losing upward momentum, indicating a potential shift in sentiment. Additionally, the price is consolidating below the pivotal resistance of 1.0925. These factors suggest the possibility of a bearish correction.

Downside Potential:

If the bearish correction materializes, the initial target would be 1.0840, which corresponds to the 23.60% Fibonacci retracement level. A break below this level could extend the correction further, potentially targeting 1.0800.

Upside Potential:

However, traders should be aware that a return of trading stability above 1.0920, and more importantly, a break above 1.0925, could invalidate the bearish scenario. In this case, the pair could regain its upward momentum, targeting 1.0950 and potentially 1.1000.

Key Levels:

- Resistance: 1.0920, 1.0925, 1.0950, 1.1000

- Support: 1.0840 (23.60% Fibonacci retracement), 1.0800

Conclusion:

The EUR/USD pair is currently in a wait-and-see mode, with conflicting signals indicating both the potential for a bearish correction and a continuation of the upward trend. Traders should closely monitor the price action around the key levels mentioned above and exercise caution in their trading decisions.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations