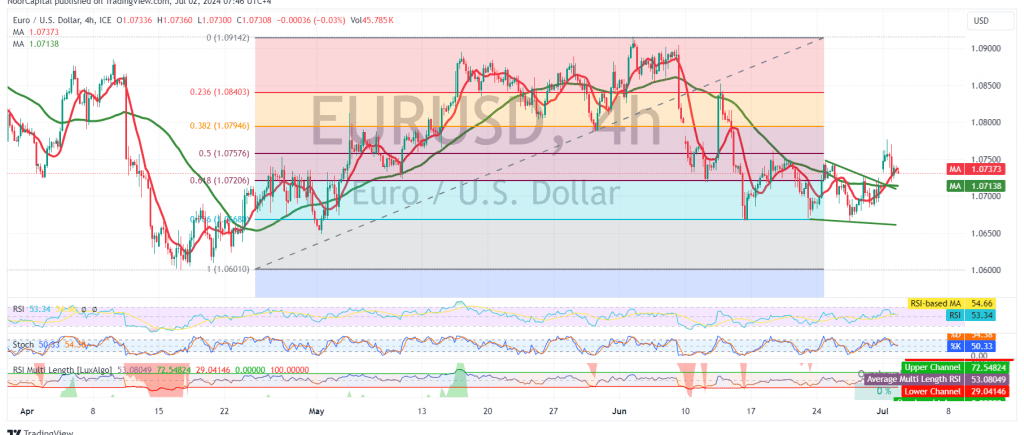

The EUR/USD pair has experienced positive trades in early week trading but faces resistance at the 1.0760 level (50.0% Fibonacci retracement).

Technical Outlook:

On the 4-hour chart, the pair is consolidating below 1.0760, but the simple moving averages (SMAs) are providing support from below, suggesting potential for further upside. However, the Stochastic oscillator is showing negative signals, indicating a potential loss of momentum.

Possible Scenarios:

The conflicting signals warrant a cautious approach, with two potential scenarios:

- Upward Breakout: A clear and strong break above 1.0760 would confirm a bullish trend, targeting 1.0800/1.0795 initially, with potential to reach 1.0840.

- Downward Breakout: A decisive move below the 1.0690 support level, followed by a break of 1.0675, would signal a bearish trend, targeting 1.0630.

Key Levels:

- Resistance: 1.0760 (50.0% Fibonacci retracement), 1.0800/1.0795, 1.0840

- Support: 1.0690, 1.0675, 1.0630

Important Note:

High-impact economic data from the U.S., including job vacancies and labor turnover rate, along with a speech by the Federal Reserve Chairman, could significantly influence the EUR/USD pair. Traders should exercise caution and closely monitor the market’s reaction to these news releases.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations