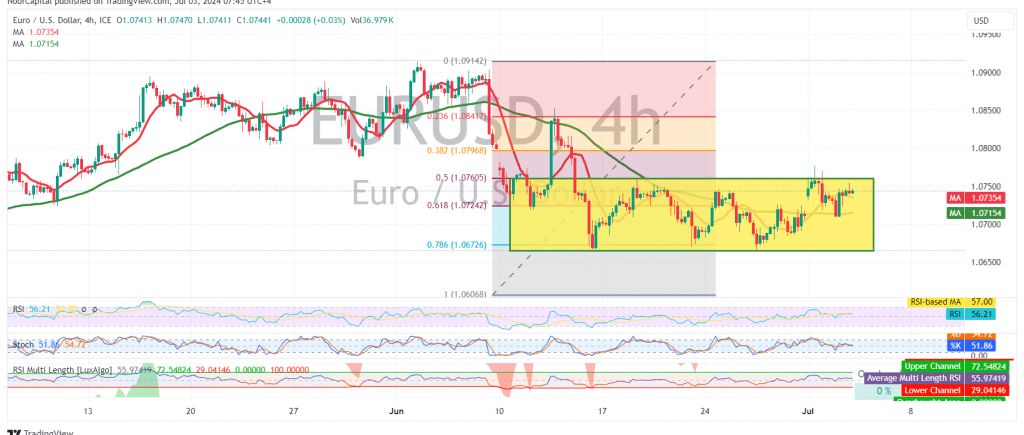

The EUR/USD pair continues to exhibit sideways movement, remaining within the 1.0720 support and 1.0760 resistance levels for the fourth consecutive session.

Technical Outlook:

On the 4-hour chart, the pair is still consolidating below the key resistance level of 1.0760, which coincides with the 50.0% Fibonacci retracement. While the Stochastic oscillator is showing negative signals, suggesting a potential downside, the simple moving averages (SMAs) are providing underlying support and hinting at a possible upward move.

Conflicting Signals and Potential Scenarios:

The persistence of conflicting technical signals necessitates continued observation of price action. Two potential scenarios remain in play:

- Upward Breakout: A clear and strong break above 1.0760 would confirm a bullish trend, potentially leading the pair towards 1.0800/1.0795, with further gains possible towards 1.0840.

- Downward Breakout: A decisive move below the 1.0690 support level, followed by a break of 1.0675, would confirm a bearish trend, targeting 1.0630.

Key Levels:

- Resistance: 1.0760 (50.0% Fibonacci retracement), 1.0800/1.0795, 1.0840

- Support: 1.0720, 1.0690, 1.0675, 1.0630

Important Note:

The release of high-impact U.S. economic data today, specifically the ADP Non-Farm Employment Change report, could trigger significant price volatility. Traders should exercise caution and closely monitor the market’s reaction to this news.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations