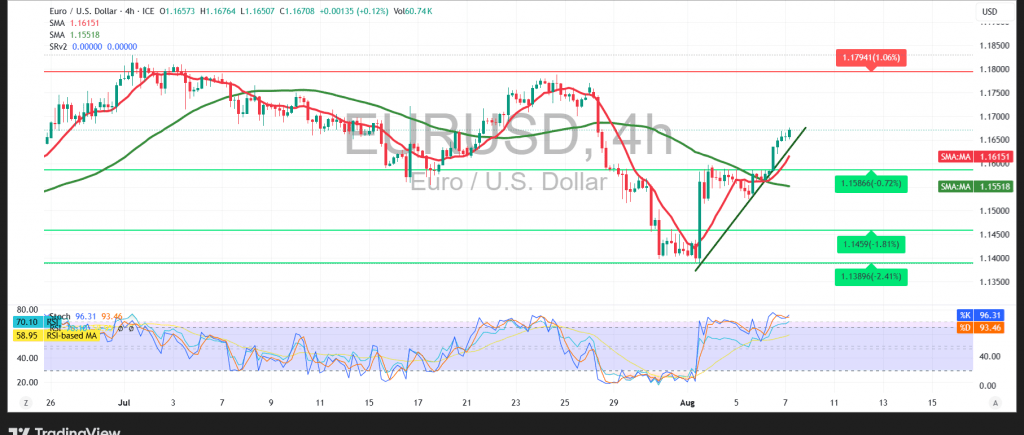

The EUR/USD pair successfully reached the bullish target at 1.1665, in line with the positive outlook presented in our previous report. The pair recorded a session high of 1.1676, confirming the continuation of its upward momentum.

Technical Outlook:

Price action remains steady above the 50-period Simple Moving Average (SMA), which continues to offer dynamic support and reinforce the prevailing uptrend. Stability above the key psychological level of 1.1600 further highlights the strength of the current support base. While the Relative Strength Index (RSI) is beginning to show signs of weakening momentum, this is likely a reflection of overbought conditions and may result in a brief consolidation phase rather than a trend reversal.

Probable Scenario:

As long as the pair holds above 1.1600, the bullish bias remains intact. A clear break above 1.1670 would likely provide fresh momentum, paving the way for additional gains toward 1.1700, 1.1710, and potentially 1.1745 in the short term.

Alternative Scenario:

Should the pair break below the 1.1600 support level and close beneath it on the hourly timeframe, downside pressure may return, with 1.1530 emerging as the next key support to monitor.

Warning:

The risk environment remains elevated amid ongoing global trade tensions. Traders should prepare for potential volatility and consider both primary and alternative scenarios in their risk management plans.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations