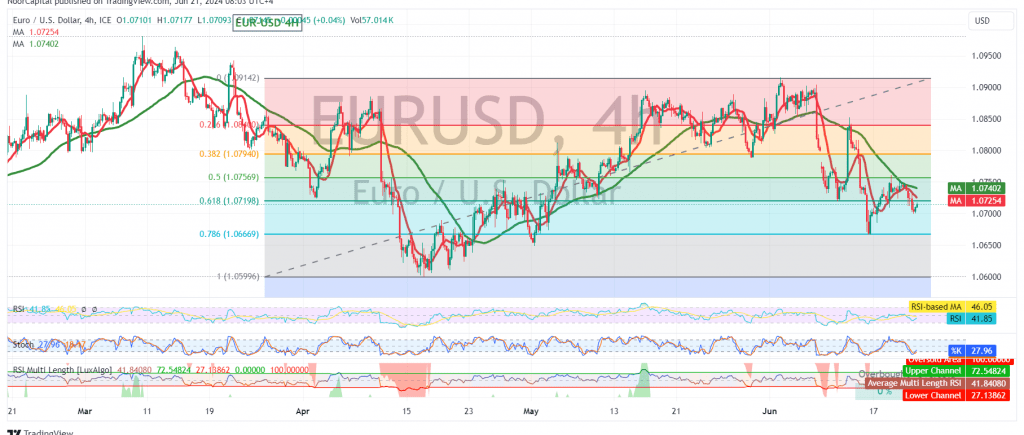

The EUR/USD pair continued its downward movement, as anticipated in our previous technical report, nearing our target of 1.0700 and reaching a low of 1.0715.

Technical Outlook:

On the 4-hour chart, the simple moving averages (SMAs) are maintaining their downward pressure, supporting the bearish price trend. The Stochastic oscillator has also lost its upward momentum, further reinforcing the negative outlook.

Downside Potential:

The potential for further decline remains significant. A break below 1.0700 would likely trigger a move towards 1.0660, with a possible extension towards 1.0630.

Upside Risks:

Traders should be aware that a breakout above the 1.0760 resistance level (50.0% Fibonacci retracement) could invalidate the bearish scenario. In this case, the pair could regain positive momentum and potentially target 1.0800.

Key Levels:

- Resistance: 1.0760 (50.0% Fibonacci retracement), 1.0800

- Support: 1.0700, 1.0660, 1.0630

Important Note:

Today’s release of high-impact economic data, including the services and manufacturing PMI indices from France, Germany, England, and the United States, could induce significant price volatility. Traders should exercise caution and closely monitor the market’s reaction to these data releases.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations