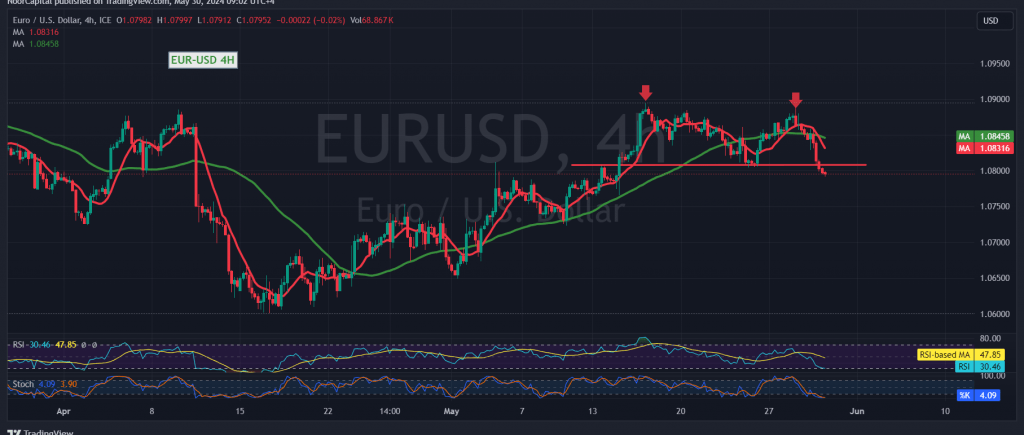

The EUR/USD pair has breached a critical support level at 1.0810, as previously highlighted in our technical analysis. This breach has triggered a wave of selling pressure, driving the pair down to a new low of 1.0790 in early trading.

Examining the 4-hour chart, we observe that the euro has broken below the ascending channel support, a significant technical development. Additionally, the simple moving averages are now exerting downward pressure on the price, further reinforcing the bearish outlook.

Based on these factors, we anticipate a continuation of the downward trend. A decisive break below 1.0770 could pave the way for a move towards the initial target of 1.0750. The ultimate target for this breakout is estimated to be around 1.0710, with potential for further losses extending towards 1.0675.

However, it’s important to note that a recovery above the 1.0840 resistance level could invalidate the bearish scenario and trigger a rebound in the euro. In this case, the initial target for the upward move would be 1.0880.

Caution is advised today, as the U.S. economy is set to release high-impact economic data, including unemployment benefits and the preliminary reading of quarterly gross domestic product (GDP). These releases could lead to significant price volatility.

Traders should closely monitor these developments and adjust their strategies accordingly. The euro’s fate now hangs in the balance, with the potential for both further declines and a bullish reversal.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations