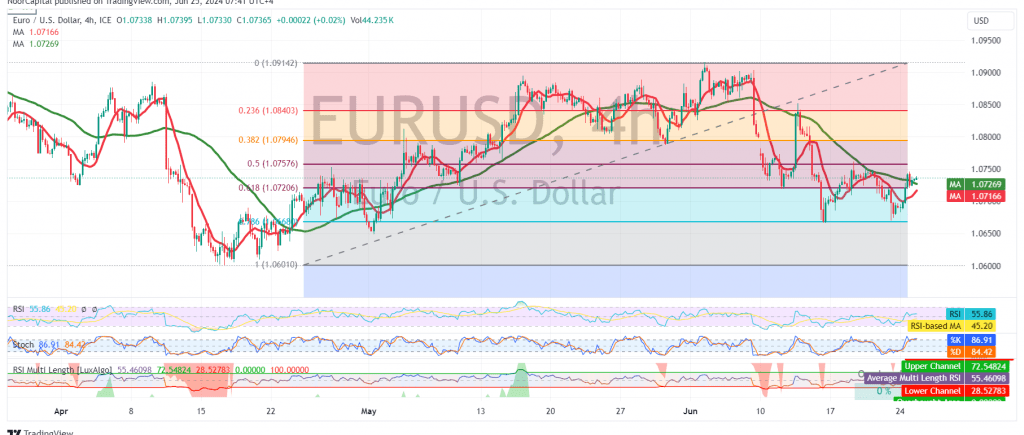

The EUR/USD pair experienced mixed trading with a negative bias in the previous session, breaking below the 1.0700 psychological support level and reaching a low of 1.0683. However, the pair has since rebounded and is currently stabilizing above 1.0700, notably holding above the 61.80% Fibonacci retracement level of 1.0720.

Technical Outlook:

The 240-minute chart reveals a mixed technical picture. The 50-day simple moving average (SMA) is attempting to push the price higher, suggesting a potential upward movement. However, the Stochastic oscillator is showing signs of weakening momentum, which could indicate a possible reversal.

Potential Scenarios:

Given the conflicting technical signals, we prefer to monitor the price action in the coming hours. Two scenarios are possible:

- Upward Trend: If the pair remains above 1.0720, an upward trend is likely. The initial target would be 1.0760 (50.0% Fibonacci retracement), followed by 1.0800/1.0795, and potentially extending to 1.0840.

- Bearish Continuation: A clear break below 1.0700, and more importantly 1.0690, would confirm the continuation of the bearish trend. This could lead to a decline towards 1.0660 and 1.0630.

Important Note:

The release of the U.S. Consumer Confidence Index today could significantly impact the pair’s movement. Traders should exercise caution and closely monitor the market’s reaction to this data.

Key Levels:

- Support: 1.0720 (61.80% Fibonacci retracement), 1.0700, 1.0690

- Resistance: 1.0760 (50.0% Fibonacci retracement), 1.0800/1.0795, 1.0840

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations