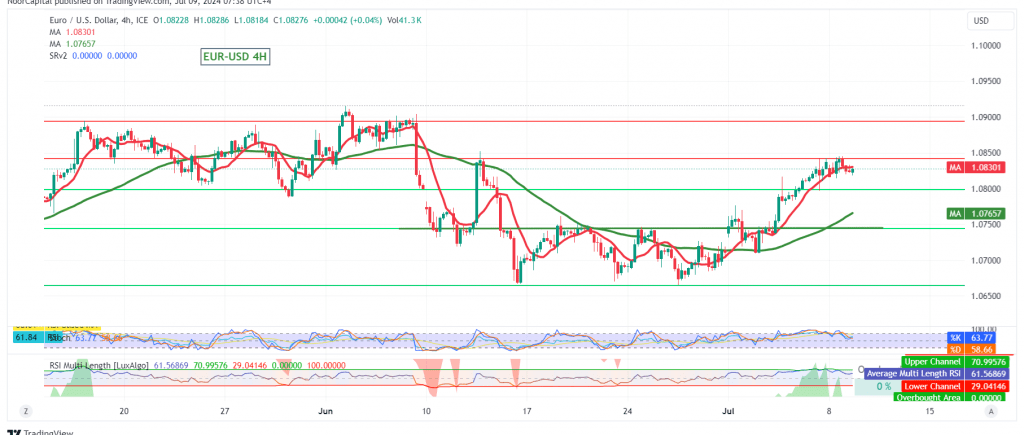

The EUR/USD pair reached our anticipated target of 1.0845 in the previous week, signaling a continuation of its upward trajectory. Technical analysis of the 4-hour chart reveals several factors supporting this bullish outlook:

Key Technical Signals:

- Resistance Breakout: The pair has decisively broken through the psychological resistance level of 1.0800, indicating strong buying pressure.

- Moving Averages: Positive crossover signals on simple moving averages (SMAs) further confirm the strengthening bullish momentum.

- Stochastic Oscillator: Clear positive signals on the stochastic oscillator add to the bullish sentiment, suggesting that the upward movement is likely to continue.

- Fibonacci Retracement: The pair’s ability to break and hold above the 50.0% Fibonacci retracement level of 1.0760 has turned this level into a solid support zone.

Upward Potential:

With the current technical setup, the EUR/USD pair has the potential to accelerate its upward movement. The next primary target lies at 1.0840. A decisive break above this level could open the door for a further rally towards 1.0880 and possibly even 1.0915.

Downside Risks:

While the overall outlook is bullish, traders should remain mindful of potential downside risks. A failure to hold above the critical support of 1.0760 could lead to a period of sideways consolidation or even a bearish reversal. A break below the 61.80% Fibonacci retracement level of 1.0720 would signal a significant shift in sentiment, potentially targeting 1.0660.

Caution:

Today, the release of high-impact economic data from the US economy, including testimony from Fed Chairman Jerome Powell and a speech by the US Treasury Secretary, could introduce significant volatility into the market. Traders are advised to exercise caution during these events and adjust their positions accordingly.

Overall Assessment:

The technical landscape for the EUR/USD pair remains bullish, with multiple indicators pointing towards continued upward movement. However, the potential for increased volatility due to upcoming economic events necessitates careful monitoring and risk management. Traders should closely watch key support and resistance levels and be prepared to adjust their strategies based on market developments.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations