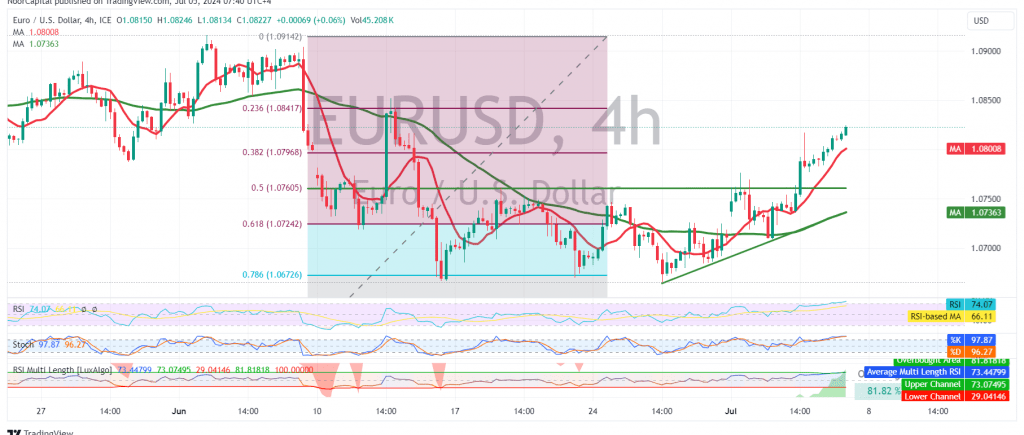

After four sessions of consolidation due to conflicting signals, the EUR/USD pair has decisively broken above the key 1.0760 resistance level (50.0% Fibonacci retracement), reaching a high of 1.0824 in early trading today.

Technical Outlook:

On the 4-hour chart, the pair is now holding above the psychological resistance of 1.0800, and the simple moving averages (SMAs) are showing positive crossover signals, reinforcing the bullish momentum.

Upward Potential:

With the 1.0760 resistance level now acting as support, the upward trend is likely to continue. Our initial target is 1.0840, and a break above this level could accelerate the rally towards 1.0880 and potentially extend to 1.0930.

Downside Risks:

However, traders should remain cautious as a return of trading stability below 1.0760 could lead to a sideways movement until the 1.0720 support level (61.80% Fibonacci retracement) is breached. This could then trigger a bearish correction with a target of 1.0660.

Key Levels:

- Support: 1.0760 (50.0% Fibonacci retracement), 1.0720 (61.80% Fibonacci retracement), 1.0660

- Resistance: 1.0800, 1.0840, 1.0880, 1.0930

Important Note:

The release of high-impact U.S. economic data today, including non-farm payrolls, unemployment rate, and average hourly earnings, could induce significant price volatility. Traders should closely monitor the market’s reaction to these data releases.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations