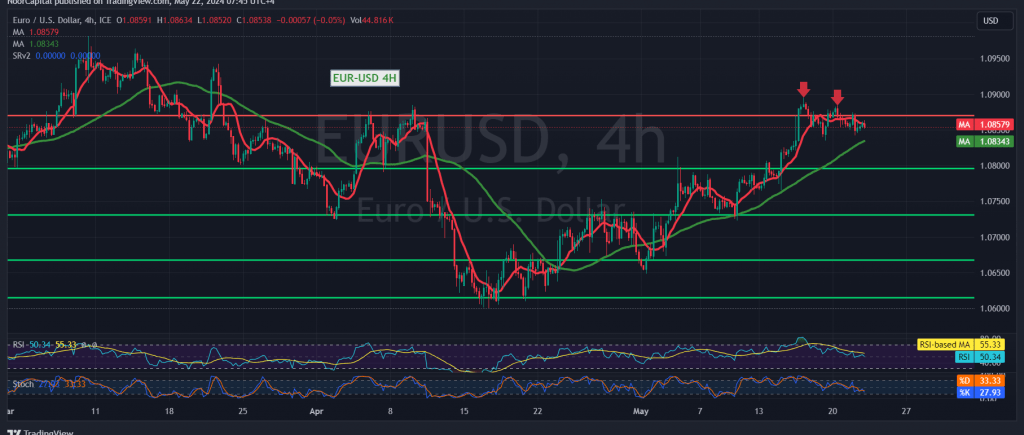

During the previous trading session, the EUR/USD pair exhibited predominantly sideways trading with a bearish bias, failing to breach the 1.0875 resistance level and consequently recording a lower peak.

Technical Analysis

A closer examination of the 240-minute chart reveals several bearish signals:

- Stochastic Indicator: Currently providing negative signals, indicating the potential for further decline.

- 14-Day Momentum Indicator: Also presenting negative signals, reinforcing the bearish outlook.

Given these technical indicators, and with daily trading remaining below the key resistance levels of 1.0875 and 1.0900, the downward trend is anticipated to continue. Should the pair break below the 1.0800 mark, it could pave the way for further declines towards 1.0735.

Potential Upside

However, a reversal scenario is possible. If the EUR/USD pair manages to stabilize and trade above the 1.0900 level, it could invalidate the bearish outlook. In this case, we might witness a temporary recovery, with the pair potentially rising to the 1.0970 level.

Market Volatility Alert

It is important to note that today’s market may experience significant volatility due to the release of highly influential economic data from the United States, specifically the results of the Federal Reserve Committee meeting. Traders should be prepared for potential price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations