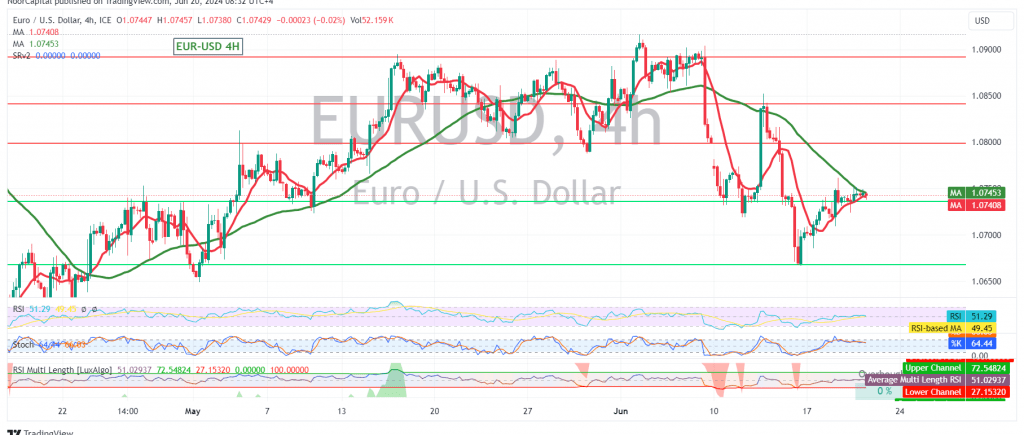

The EUR/USD pair experienced narrow sideways movement during the previous session, reflecting the subdued trading activity due to the U.S. market holiday. The overall bearish context remains intact.

Technical Outlook:

On the 4-hour chart, the 50-day simple moving average (SMA) continues to act as a significant barrier around the 1.0760 resistance level, reinforcing its strength. Additionally, clear negative crossover signals on the Stochastic indicator further support the bearish bias.

Downward Trend Potential:

The potential for a resumption of the downward trend remains high. The initial target is 1.0700, and a break below this level could pave the way for further declines towards 1.0660, with a possible extension towards 1.0600.

Upside Potential:

However, traders should remain aware that a breakout above 1.0800 and subsequent consolidation would invalidate the bearish scenario. In this case, the pair could regain positive momentum and potentially target 1.0840.

Key Levels:

- Resistance: 1.0760, 1.0800

- Support: 1.0700, 1.0660, 1.0600

Important Note:

Today’s release of high-impact economic data, including the interest rate decision, monetary policy summary, and Monetary Policy Committee vote on interest rates from the British economy, as well as unemployment benefits data from the U.S. economy, could lead to significant price volatility. Traders should exercise caution and closely monitor the market’s reaction to these data releases.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations