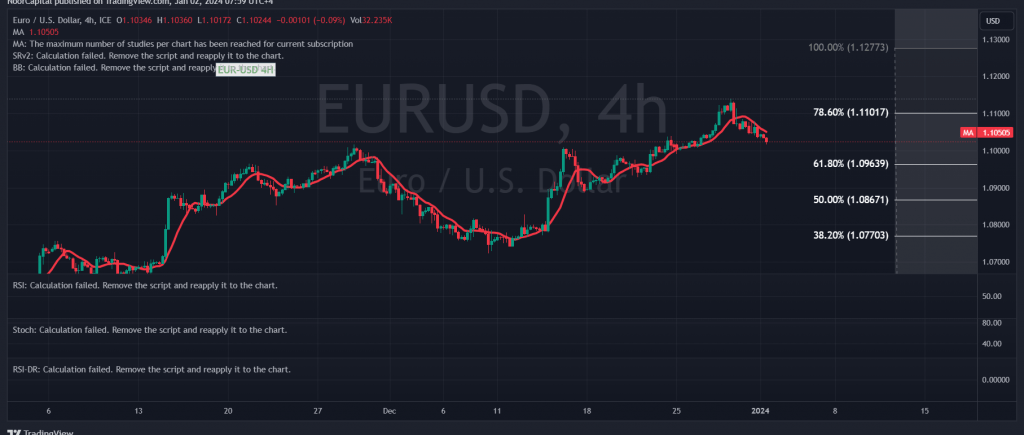

The upward trend continued to control the movements of the EUR/USD pair, as we expected, touching the official target required to be achieved during the previous technical report, located at the price of 1.1120, recording its highest level of 1.1122.

On the technical side today, we are leaning towards positivity, relying on the simple moving averages continuing to provide a positive incentive, in addition to the pair’s success in intraday stability above the psychological barrier resistance level of 1.1100, and in general above the level of 1.1060.

From here, with intraday trading remaining above 1.1060, there may be a possibility of resuming the rise towards 1.1150 first, and breaching it will enhance the gains, making the way open to visit the next targets around 1.1185, and the gains may extend later towards 1.1245.

Closing at least an hour candle below 1.1060 puts the pair under negative pressure with the aim of retesting 1.0960, the 61.80% Fibonacci retracement, before attempts to rise again.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations