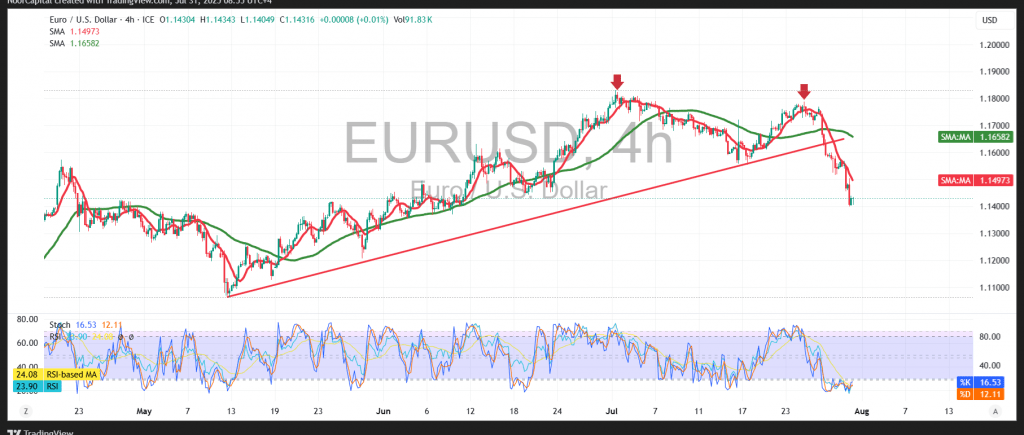

The euro continues to extend its losses against the U.S. dollar, aligning with the bearish outlook presented in previous reports. The pair reached the anticipated technical target at 1.1445 and registered a new low at 1.1405.

Technical Outlook:

Currently, the pair is undergoing a limited recovery attempt, aiming to retrace part of the previous session’s losses. However, the price remains below the 50-period Simple Moving Average (SMA), which continues to serve as a dynamic resistance level. In addition, early signs of a bearish “double top” pattern are beginning to emerge, adding further weight to the bearish scenario.

Probable Scenario:

As long as the price remains below the resistance levels at 1.1530 and, more importantly, 1.1560, the downside bias remains intact. A confirmed break below the key psychological support at 1.1400 would likely open the path for further declines, with 1.1360 as the next support level, followed by 1.1310.

Alternative Scenario:

A decisive breakout and sustained trading above the 1.1560 resistance level would temporarily shift the technical outlook to the upside, with a potential rebound toward the next resistance at 1.1635.

Upcoming Economic Data – Volatility Alert:

Markets are likely to experience heightened volatility today due to the release of several key U.S. economic indicators, including:

- Weekly Unemployment Claims

- Core Personal Consumption Expenditures (Core PCE)

- Employment Cost Index (Quarterly)

Warning:

Given ongoing trade tensions and economic uncertainty, the risk level remains elevated. Traders should be prepared for sharp intraday fluctuations and account for all possible scenarios.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations