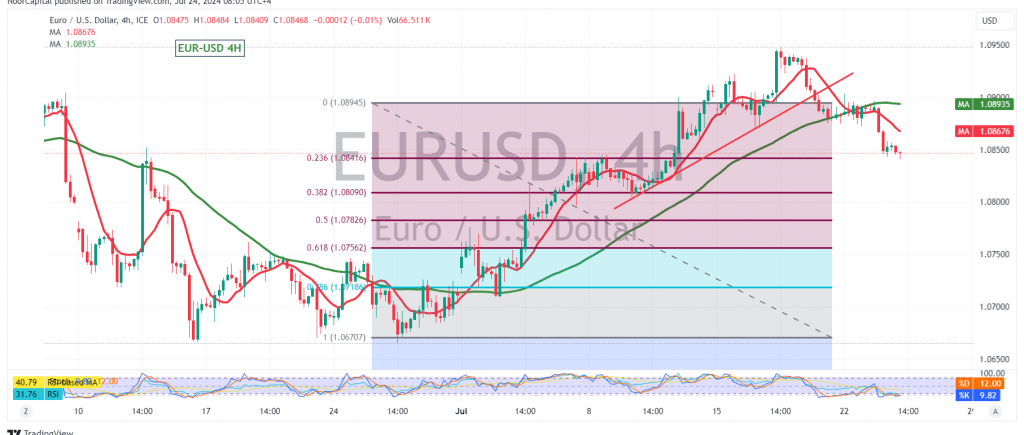

The euro declined against the US dollar as anticipated in our previous technical report, reaching the initial target of 1.0840, with the lowest trading level during the morning session at 1.0840.

From a technical perspective, the 240-minute chart shows negative crossover signals from the simple moving averages, suggesting the likelihood of a continued decline. This is further supported by the clear negative signals on the 14-day momentum indicator.

Given these indicators, there is a potential for the euro to continue its downward correction, possibly targeting 1.0810, which corresponds to the 38.20% Fibonacci retracement level. A drop below this level could extend the decline towards the next key support at 1.0775, representing the 50.0% retracement.

On the upside, if the euro stabilizes above 1.0920, it could regain its strength, potentially leading to a positive trading session. In this scenario, the initial target would be 1.0950, with a possible extension towards 1.1000.

Note: Today, we anticipate high-impact economic data releases, including the preliminary readings of the services and manufacturing PMI indices from the Eurozone, the United Kingdom, and the United States, as well as the Canadian interest rate decision and the Bank of Canada’s press conference. These events may result in significant price volatility.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations