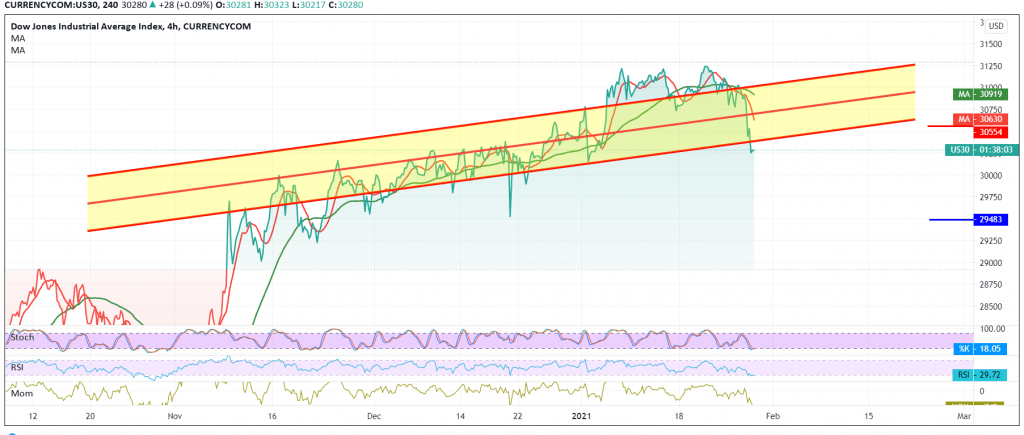

The Dow Jones Industrial Average declined significantly during the previous trading session, to cancel the positive outlook and touching the stop-loss order. We indicated that trading below 30,615 is able to completely negate the Bullish Scenario and we may witness a strong bearish tendency, with an initial target around 30,470, recording the lowest price at 29,950, offsetting a portion of losses.

On the technical side today, with the index failing to maintain the trading level above 30,340, in addition to the positive signs coming from the RSI and stabilizing below the 50 midline.

Consequently, the index may continue its bearish tendency to target 29,950, while confirming the breach of the aforementioned level will extend the index’s losses so that the way is directly open towards 29,460.

From the top, Rising above 30,340 delays the chances of a reversal, but does not cancel them, and we may witness a bullish tendency targeting a retest of the broken support 30,500.

Note: The risk level is still high.

| S1: 29820 | R1: 30680 |

| S2: 29460 | R2: 31170 |

| S3: 28965 | R3: 31540 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations