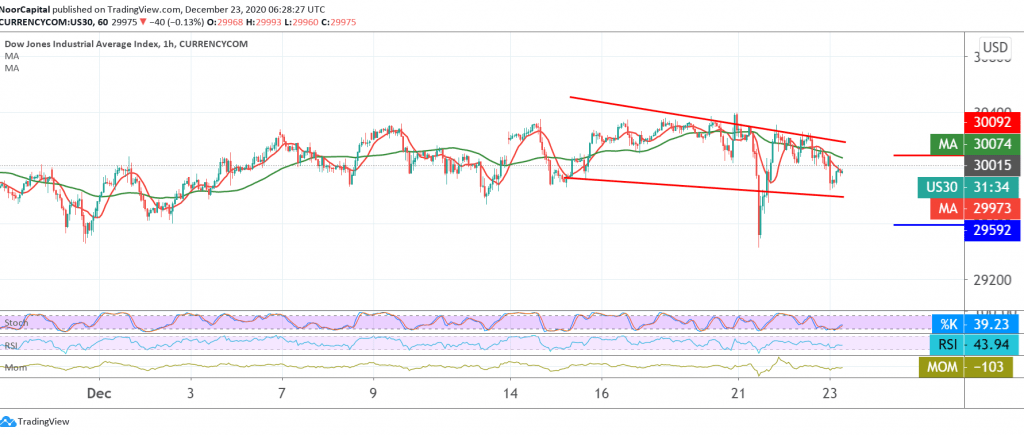

The Dow Jones Industrial Average declined significantly on Wall Street during the previous session, recording its lowest level at 29,734.

On the technical side, and with a closer look at the 60-minute chart, we find that the simple moving averages continue to pressure the price from the top, supported by the clear negative signs on the RSI.

Therefore, the bearish scenario will remain valid and effective targeting 29,690 as a first target, bearing in mind that breaking the aforementioned level puts the price under strong negative pressure, its next target is around 26,590.

Activation of the suggested scenario depends on trading remaining below 30,100.

Warning: the level of risk is high.

| S1: 29685 | R1: 30100 |

| S2: 29510 | R2: 30330 |

| S3: 29275 | R3: 30510 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations