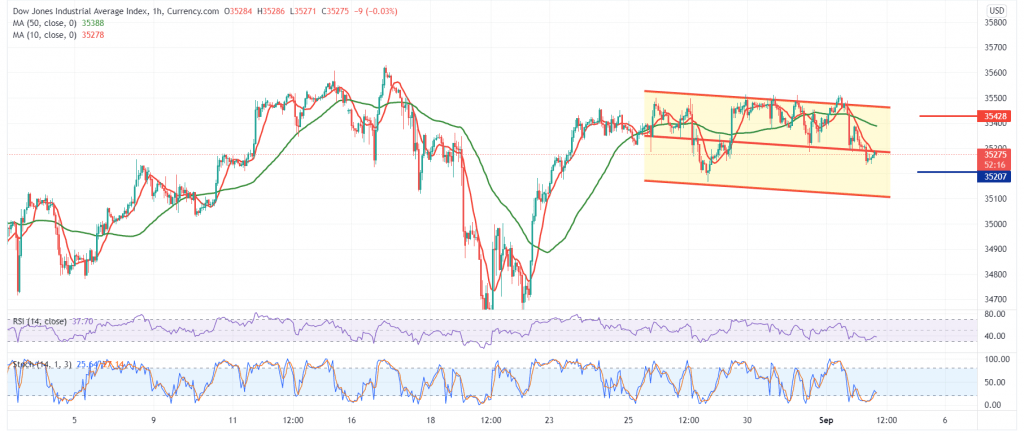

Negative trading returned to dominate the Dow Jones Industrial Average movements after it faced a hurdle to surpass the resistance level of 35,500.

On the technical side, stochastic has started to provide negative signals, missing the bullish momentum, and this comes in conjunction with the negative signals coming from the RSI.

We tend to be negative in the coming hours, targeting 35,200 and 35,150, respectively, knowing that the confirmation of the latter’s break extends the index’s losses, so we are waiting for a retest of the pivotal support 35,050.

The return of trading stability above 35,425 will stop the bearish bias, and the index will recover again, with the first target of 35,500, and the biases may extend towards 35,570. Note: the risk level is high.

| S1: 35150 | R1: 35425 |

| S2: 35050 | R2: 35595 |

| S3: 34870 | R3: 35700 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations