The Dow Jones Industrial Average succeeded in achieving the negative outlook, as we expected during the last analysis, touching the target of 31,210, recording a low of 31,188.

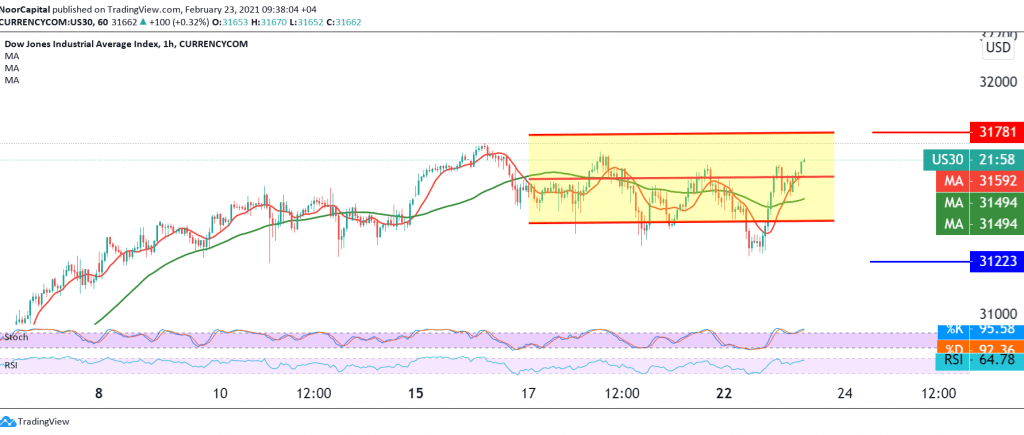

On the technical side today, and with a closer look at the 60-minute chart, we find the RSI continues to get negative signals, accompanied by the stability of intraday trading below 31,670/31,680.

Consequently, we may witness a bearish tendency during the coming hours, targeting 31,220 as a first target, bearing in mind that confirming a break of 31,220 will extend the index’s losses so that the way is directly open towards 31050.

From the top, crossing to the upside and stabilizing the price above 31,680 negates the bearish scenario and leads the index to an upside path, its initial target 31,745 and may extend later towards 31,880.

Note: The risk level may be high.

| S1: 31320 | R1: 31745 |

| S2: 31050 | R2: 31880 |

| S3: 30900 | R3: 32165 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations