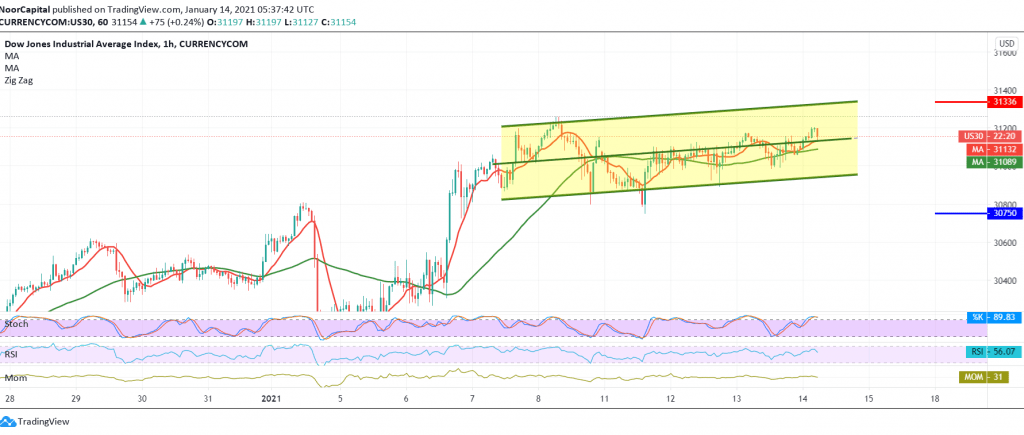

The Dow Jones Industrial Average found a strong resistance level around 31,080, as the current movements of the index witnessed a steady bearish tendency around its lowest level during the current trading session at a price of 31,020.

On the technical side, we tend to the temporary negativity depending on the negative signs of the RSI, in addition to the stability of the intraday 31,120 tradings.

Therefore, we target a retest of 30,890, the first target, and breaking it puts the price under negative pressure to continue the temporary descending path towards 30,775.

From the top, trading above 31,120 will immediately stop the bearish tendency and recover the index again to continue trading within the official bullish trend, with the target of 31,220 and then 31,340 respectively.

| S1: 30895 | R1: 31120 |

| S2: 30775 | R2: 31220 |

| S3: 30675 | R3: 31340 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations