We remained neutral during the previous analysis, explaining that the activation of selling positions depends on confirming that the index has broken the support level of 30,870 so that the price heads to visit 30,710 posting low of 30,776.

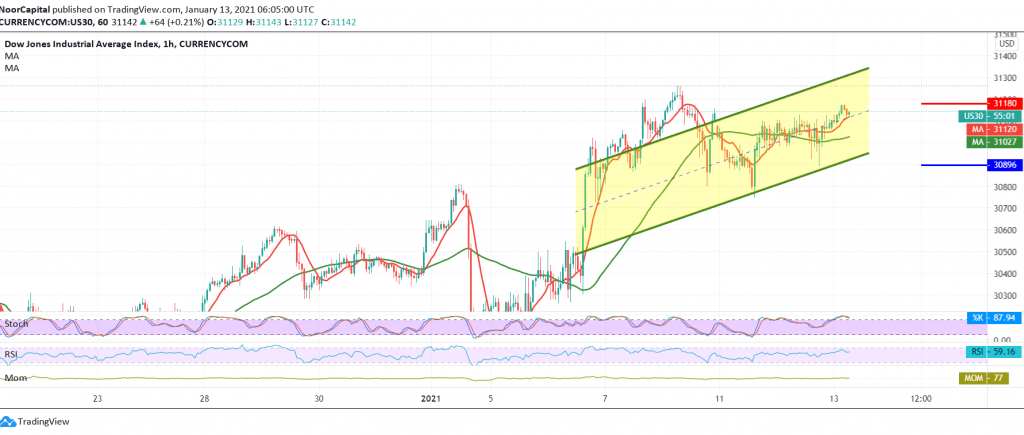

Technically, and with a closer look at the 60-minute chart, we find the RSI losing the bullish momentum gradually, in addition to trading remaining below the resistance level 31,120.

Therefore, we may witness a slight bearish tendency during the coming hours, targeting 30,840 the first target and may extend to the second target 30,790.

Overcoming to the upside and rising again above 31,120 will immediately stop the downside trend and the index will recover with the first target of 31,230 and gains may extend later towards 31,330.

| S1: 30840 | R1: 31120 |

| S2: 30665 | R2: 31230 |

| S3: 30560 | R3: 31410 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations