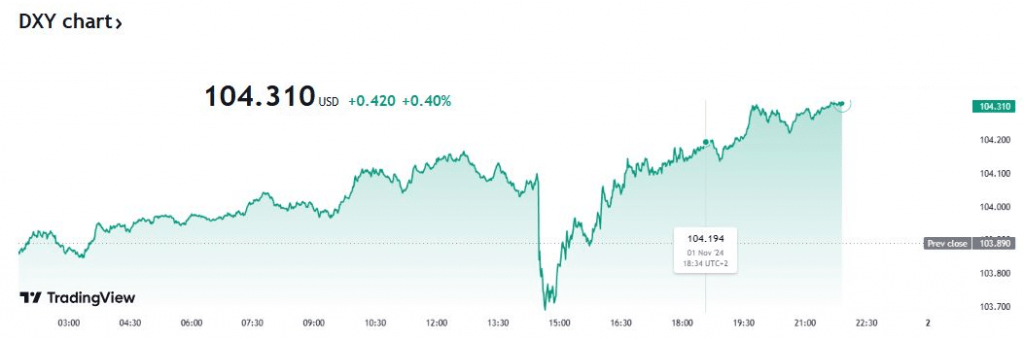

The US Dollar, once an unfaltering symbol of global financial stability, has recently exhibited a volatile performance. While it initially surged on the back of aggressive interest rate hikes by the Federal Reserve, it has since retreated as market expectations for future tightening have moderated. The confluence of economic factors, including persistent inflation, slowing growth, and geopolitical tensions, has created a complex backdrop for the greenback which is 0.40% up on Friday, closing the trading week around the 104.310 mark, at the time of writing.

DXY Index, Daily Chart – Source: TradingView

Recent Economic Indicators, Their Impact on USD

The recent release of economic data has further complicated the Dollar’s outlook. The October Nonfarm Payroll report, while indicating slower job growth, also highlighted persistent wage inflation. This conflicting data has raised concerns about the Fed’s ability to ease monetary policy without exacerbating inflationary pressures.

The manufacturing sector, as measured by the ISM Manufacturing PMI, contracted further in October, signaling ongoing weakness. Conversely, the Services PMI remained in expansionary territory, suggesting resilience in the service sector.

Market Expectations for Dollar’s Outlook

Financial markets have largely priced in a 25 basis point rate cut by the Federal Reserve at its upcoming meeting. This expectation has weighed on the US Dollar, as lower interest rates typically reduce a currency’s appeal to investors. However, the persistence of inflationary pressures could complicate the Fed’s decision-making process. If inflationary pressures remain elevated, the central bank may need to adopt a more cautious approach to monetary easing, which could support the Dollar.

Technical Analysis: A Cautious Stance

From a technical perspective, the US Dollar Index (DXY) has been trading sideways, consolidating around the 200-day Simple Moving Average (SMA) support level. While this suggests potential downside risk, the index’s resilience near this key support level indicates that buyers may still be defending the currency.

However, a break below the 104.00 level could signal further weakness, potentially leading to a more pronounced decline. Conversely, a sustained move above 104.70 could indicate a potential bullish reversal, suggesting renewed strength in the Dollar.

Geopolitical Risks, Safe-Haven Demand

Geopolitical tensions, particularly those stemming from the ongoing Russia-Ukraine conflict and rising Sino-US rivalry, have also played a role in the Dollar’s performance. During periods of heightened geopolitical uncertainty, the Dollar often benefits from its status as a safe-haven currency. However, as these tensions ebb and flow, their impact on the Dollar’s value can be unpredictable.

The US Dollar’s future trajectory remains uncertain, as it is caught between conflicting economic signals and geopolitical risks. While a rate cut could weaken the currency in the short term, persistent inflationary pressures and geopolitical tensions could provide support. Investors and traders should closely monitor economic data releases, central bank policy decisions, and geopolitical developments to gauge the Dollar’s potential direction. As the global economic landscape continues to evolve, the Dollar’s role as a safe-haven currency and its sensitivity to interest rate differentials will remain key factors influencing its value.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations